The Dividend Note - adding to my watch list - SMWH, REC, HIK (26/04/24)

I review this week's updates from UK dividend shares Hikma Pharmaceuticals, WH Smith and Record, and find much to like.

Welcome back to The Dividend Note. This week I've take a careful look at the latest accounts from travel-focused retailer WH Smith. Has recent weakness created a buying opportunity?

I've also reviewed trading updates from small cap currency management specialist Record and FTSE 100 dividend share Hikma Pharmaceuticals, which specialises in producing generic medicines.

Sidetracking briefly, I also see that Google owner Alphabet has just declared its first ever dividend. The tech giant (market cap $2tn!) now intends to make quarterly cash payouts. Facebook owner Meta has also introduced dividend payments recently.

Perhaps we'll soon look back and wonder at a period when it became unfashionable for company owners to expect to receive a share of profits in cash each year...

Companies covered

These notes contain a review of my thoughts on recent results from UK dividend shares that are of interest to me. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- WH Smith (LON:SMWH) - aggressive growth plans in North America aren't without risk and are putting pressure on margins and cash generation. But my overall impression is positive. I think the pre-pandemic qualities of this business remain largely intact and the valuation could be attractive.

- Record (LON:REC) - the full-year update from this currency management specialist reads positively to me, except it fails to confirm whether results for the year just ended will be in line with forecasts. Record goes onto my watch list ahead of June's full-year results.

- Hikma Pharmaceuticals (LON:HIK) - this Q1 update strikes a positive tone, but broker forecasts suggest earnings may fall slightly this year. I admire Hikma's long-term record of value creation and think the shares could be reasonably priced at current levels.

WH Smith (SMWH)

"The second half of the financial year has started well, and we are on track to deliver full year expectations."

Half-year results / Mkt cap: £1.6bn

FY24 forecast dividend yield: 3.0%

The story so far: prior to the Covid pandemic, WH Smith was priced as a company that could do no wrong. To a large extent, the group's results supported this view.

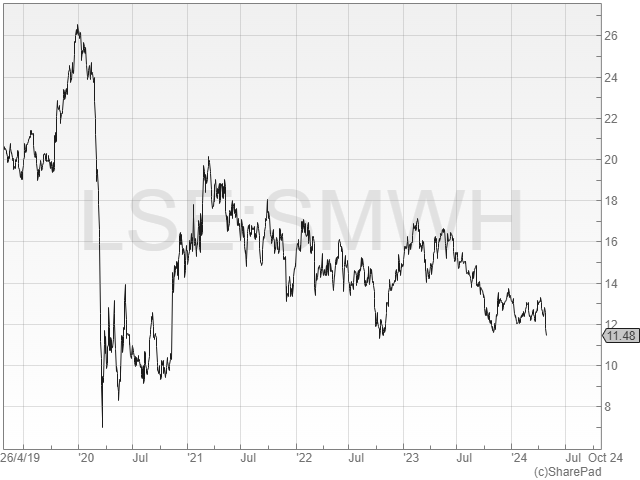

Shareholders enjoyed a total return of more than 600% between 2006 and the start of the pandemic – equivalent to 13.6% annualised:

The group's business model is based on combining a fast-growing international travel retail business with a declining UK high street business that's run for cash.

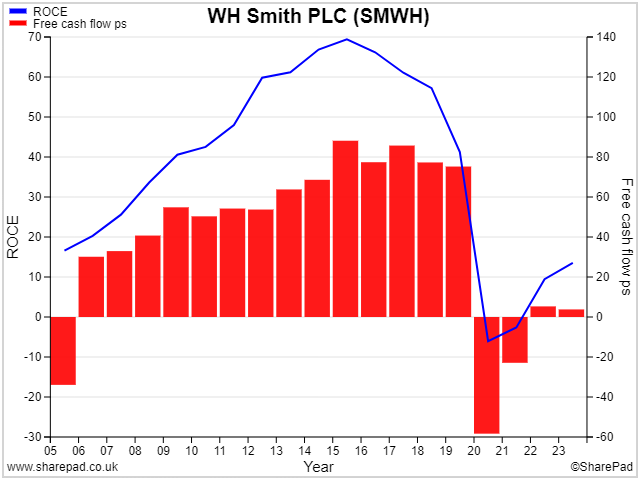

Historically, this combination delivered strong free cash flow and high returns on capital employed:

Dividends and buybacks were used assiduously to reward shareholders. Then it all went wrong:

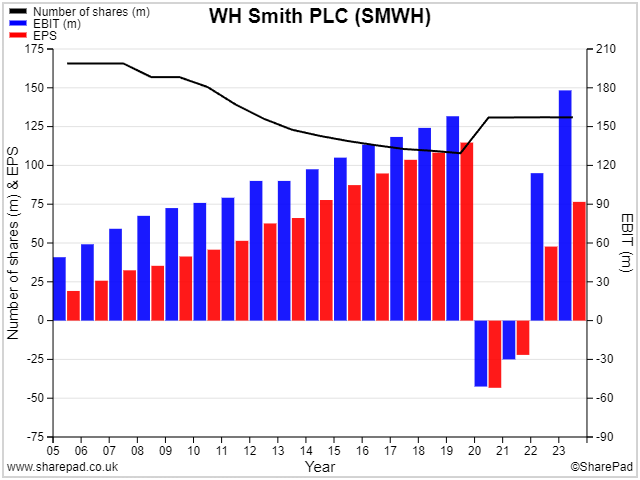

A buying opportunity? One of the hallmarks of a good business is its ability to overcome problems and maintain its strategy. WH Smith appears to have done this. As the chart above shows, operating profit growth is now back in line with the pre-pandemic trend.

Earnings per share haven't yet caught up with headline profits, due to the dilution from an equity placing in 2020 and the impact of higher interest costs on increased debt levels.

This week's interim results drew an unfavourable response from the market and the shares are now trading at 2020 levels. The share price recovery in 2021 has completely reversed.

This has left WH Smith shares trading on 13 times forecast earnings and offering a c.3% yield.

I would have been very happy to buy the stock at this level prior to the pandemic, so I thought it would be interesting to take a closer look now to see if the company's historic appeal is still intact.

Is the current slump a buying opportunity?

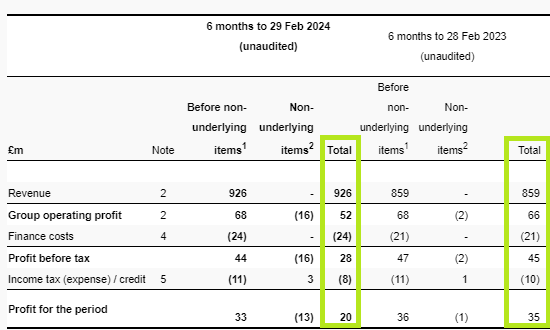

H1 2023/24 results summary: WH Smith's half-year results cover the six months to 29 February 2024.

The company says it saw strong momentum across all of its market, particularly in travel.

UK Travel was the strongest performer, delivering a 19% increase in trading profit during the period. North America also generated a positive result, with the InMotion business now fully integrated and further store openings planned in H2.

The group's expansion into other countries is continuing, with revenue up by 24% to £121m on a constant currency basis. These operations remain loss-making in aggregate (trading profit: -£1m in H1) but are expected to become profitable in due course.

The UK high street business continued to limp on, with sales down 4% at £256m and a reduced trading profit of £22m (H1 '23: £24m).

WH Smith's headline (adjusted) financial numbers show progress from last year, albeit with lower margins than the comparable period:

- Group revenue up 8% to £926m, with travel revenue up 13%

- Headline pre-tax profit up 2.2% to £46m

- Travel trading profit up 6.4% to £50m

- High street trading profit down 8.3% to £22m

- Headline earnings per share up 5% to 24.4p

- Interim dividend of 11p per share (H1 '23: 8.1p)

Of course, these headline numbers exclude a number of adjustments. These totalled £16m during the first half of the current year, resulting in a sharp drop in reported profits. Higher finance costs also had an impact:

Non-underlying items: the largest adjusting item was a £9m impairment charge on "the store and online portfolio". This was made up as follows:

- £4m to property, plant and equipment - no detail provided

- £2m to intangible assets - "primarily software"

- £3m to right-of-use assets - i.e. store leases

There was also a £2m charge relating to "onerous contracts". This appears to imply the company is locked into a loss-making contract of some kind:

"the unavoidable costs of continuing to service a non-cancellable contract."

The other adjusting items relate to the pension scheme and to amortisation charges and do not look a particular concern to me.

Profitability: using statutory profits, as is my habit, WH Smith generated an operating margin of 5.6% and a return on capital employed of 12.2%, calculated on a trailing 12-month basis.

Both figures are well below the levels achieved in the past, in part because goodwill on the balance sheet has risen from £41m in 2018 to £437m today. This largely reflects two sizeable acquisition in North America, MRG and InMotion.

For illustration, stripping out the goodwill gives a return on capital employed of just under 20%. This suggests two things to me:

- WH Smith probably paid a full price for its acquisitions

- The economics of this business probably remain attractive if it can generate organic growth (i.e. not just expanding through acquisitions)

Growth remains a core focus of the business, with "80 new stores won and yet to open in Travel".

CEO Carl Cowling expects to open c.110 new stores in total during the current financial year, which ends on 31 August.

However, the company also expects to close 60 stores as it focuses on better quality space. I would imagine these closures may have contributed to some of the impairment charges listed above.

Free cash flow: WH Smith's travel growth plans are having an impact on free cash flow as it invests in new stores and supporting infrastructure such as warehousing.

Interest payments are also sucking cash out of the business. Borrowing costs rarely troubled the company prior to the pandemic, when it tended to maintain a net cash position.

One final factor impacting cash flows is the seasonality of the travel business, which led to a working capital outflow of £68m during the first half of the year.

Fortunately, management provides a breakdown of growth capex and maintenance capex. This is useful because it allows us to take a view on steady-state cash performance, excluding spending on new stores that may not yet be contributing free cash flow.

In order to get a more meaningful picture of WH Smith's cash performance, I've calculated the following free cash flow figures on a trailing 12-month basis for the period to 29 February 2024:

- Total free cash flow: £16m

- Free cash flow excluding spending on new stores: £78m

- Free cash flow excluding new stores and working capital movements: £116m

Of these three, I would say that free cash flow excluding new store capex is the most useful measure of the underlying cash performance of the business. At £78m, this compares well with trailing 12-month net profit of £73m, implying excellent underlying cash conversion of 107%.

Free cash flow of £78m gives an underlying free cash flow yield of 5%, based on the current £1.55bn market cap.

While WH Smith is currently opting to allocate a sizeable proportion of this surplus cash to fund new store openings, these can be slowed or even stopped if necessary.

Debt: one factor that would improve WH Smith's profitability and cash generation would be a reduction in debt levels. Interest payments on debt rose to £26m last year (FY22: £23m) and totalled £13m during the first half of this year.

These payments relate to headline net debt (excluding lease liabilities), which rose to £437m at the end of February, from £330m at the end of the last financial year.

The company says this represents a multiple of 1.8x EBITDA on a covenant basis. Leverage is expected to fall to between 0.75x and 1.25x EBITDA by the end of the current financial year.

Based on broker forecasts, this guidance implies headline net debt of between £270m and £450m at the end of the current financial year.

That seems quite a wide range to me. I'm not sure if this reflects a lack of visibility on costs and earnings or spending decisions that haven't yet been made.

However, broker forecasts for a FY24 net profit of £118m suggest to me that the company's leverage should fall below my preferred limit of four times net profit by the end of August. I don't see WH Smith's debt as a concern that would prevent me investing.

My view

WH Smith sees a significant growth opportunity in North America and is investing heavily with a view to achieving a 20% market share in travel:

"our focus for this division is and has been centred on winning and opening new stores with a target of building market share to 20% over the next four years. The new space opportunities are substantial. Our analysis of the North American market shows that there is a total of approximately 2,000 news and gift and specialty retail stores across the top 70 airports, of which we currently operate or have won over 260 stores"

A 20% market share of 2,000 stores would be 400, implying a further 50% increase in the company's current North American store estate.

Scaling up the group's US logistics infrastructure and maintaining a relatively high rate of new store openings is putting pressure on margins. It also carries the risk that future returns on this spending will be lower than expected.

However, the long-running success of the group's UK travel business – where margins topped 10% in H1 – gives me some confidence that the company's targets are credible and that is has the capacity to deliver on them.

If WH Smith can replicate the profitability of its UK travel business in North America, then I think the combined business could be worth significantly more in the future.

As things stand today, I think WH Smith looks reasonably valued based on its current business. Looking ahead, I think the shares could potentially be cheap, if the company can maintain financial discipline and deliver on its growth targets.

WH Smith goes on my watch list, for now.

Record (REC)

"AUME increased by 17% to US$102.2 billion"

FY24 trading update (y/e 31 Mar)/ Mkt cap: £122m

FY24 forecast dividend yield: 8.1%

Asset manager Record's niche is providing services to manage its clients' currency exposures. The group serves mainly institutional clients and currently provides hedging for more than $100bn of client assets.

Record's core services are passive hedging and dynamic hedging. The passive service aims to neutralise the economic impact of a client's currency exposure. The more expensive dynamic service is designed to allow for FX gains while providing protection from losses.

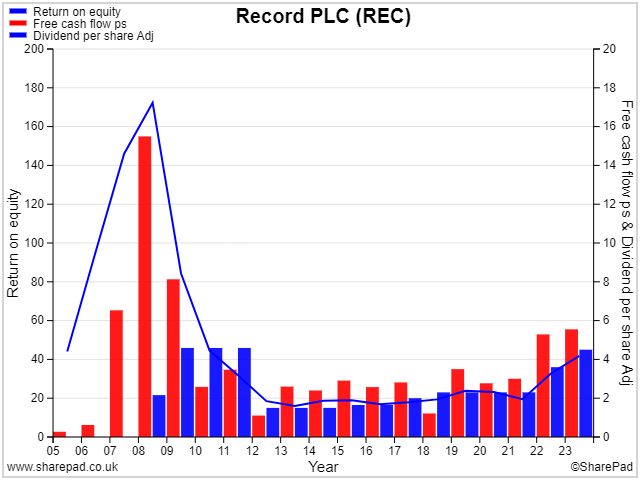

Record is notable for its strong profitability and excellent cash generation. These currently support an 8% dividend yield.

I last commented on this business in June 2023, when I voiced doubts about the company's diversification plans. My concern was that Record might be entering into markets where it had no obvious competitive strengths.

Since then, CEO Leslie Hill – who devised this diversification strategy – has retired and been replaced by Dr Jan Witte, who took charge on 1 April, the start of Record's new financial year.

FY24 trading summary: Record uses the measure Assets Under Management Equivalent (AUME) to measure business flows. This figure represents the value of client assets the company's hedging strategies are protecting.

This week's update covered the year ended 31 March 2024.

AUME: AUME rose by 17% ($14.5bn) to $102.2bn last year. This increase included net inflows of $6.8bn, in addition to positive currency movements. Dr Witte says the inflows are being driven by a mix of new clients and increased demand from existing clients.

Asset management: The company also offers currency for return products and is targeting growth in asset management. Management say that two new funds launched last year delivered net inflows of $0.3bn.

Profit guidance: one glaring omission from this update was any indication of whether profits for the year just ended would be in line with expectations.

All we were told was that average fee rates "remained broadly unchanged" and that performance fees for the year were flat at £5.8m.

It's disappointing not to get clear guidance on profits for a period that has ended.

Strategy & outlook: understandably, Dr Witte has not yet completed a full review of the company's strategy.

His comments in this year-end update are perhaps open to interpretation, but my reading of them is that he may take a more focused and targeted approach to diversification than his predecessor:

"Building on our existing proposition and the demand we observe for our services as a specialist asset manager, we are now refining our product range to focus on a select number of best-in-class products which present attractive and meaningful opportunities for us, making Record a stronger, less concentrated, and more robust business."

A full update on strategy and outlook is promised with the full-year results in June.

My view

I'm encouraged by Record's return to AUME growth. This has been lacklustre in recent years but now seems to be establishing a more positive trend.

Although I would like a little more clarity on profitability and Dr Witte's strategy plans, I'm now more interested in this business than I have been previously.

Record is currently one of the highest-scoring financial shares in my dividend screening results. The shares go on my watch list for now ahead of June's full-year results. But this is a company I might consider adding to my dividend portfolio at some point.

Hikma Pharmaceuticals (HIK)

"Full year guidance reiterated"

Q1 trading statement / Mkt cap: £4.1bn

FY24 forecast dividend yield: 3.1%

As I've commented recently, the difficulty of understanding pharmaceutical companies' future growth prospects discourages me from investing in this sector. Even so, Hikma is a stock I've owned previously and might have some interest in owning again.

Hikma does develop some of its own drugs but its main business is in producing generics. These are products whose patent protection has expired and which are typically in wide general use.

The business was founded in Jordan in 1978 and remains under the control of the founding Darwazah family. They currently occupy the board roles of executive chairman and vice chairman and control a 27% shareholding through their Darhold Ltd vehicle.

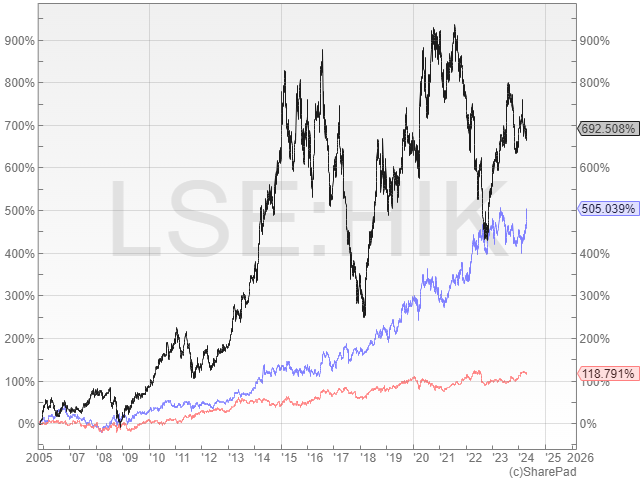

Since its IPO in 2005, Hikma has outperformed AstraZeneca and GlaxoSmithKline by a comfortable margin. This chart shows the total return to shareholders from each stock since Hikma's flotation:

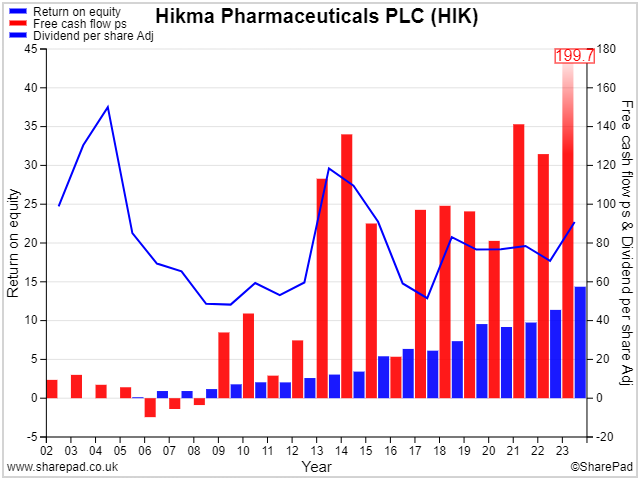

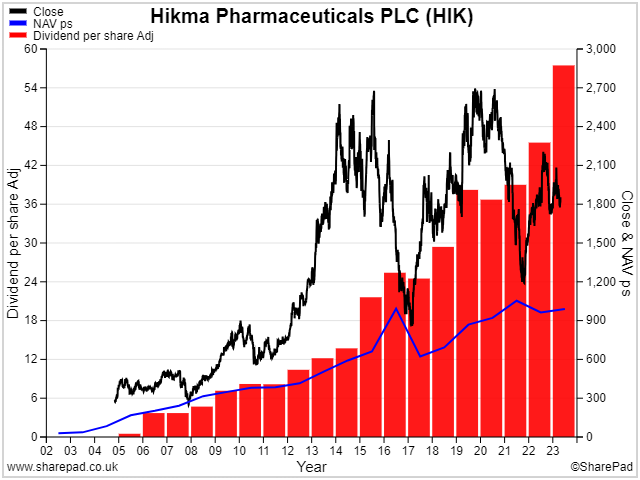

This progress has been supported by consistent high returns on equity, free cash flow expansion and 20 years of (almost) unbroken dividend growth:

Q1 trading: the company's first-quarter trading update covers the three months to 31 March.

CEO Riad Mishlawi reiterated guidance for full-year revenue growth of 4%-6% and adjusted "core" operating profit of $660m-$700m (FY23: $707m). This is clearly an in-line update, albeit one that's guiding for lower profits this year.

Mr Mishlawi strikes a positive tone:

"Our three businesses are performing well, underpinned by our strong commercial and operational capabilities. We are launching new products and expanding our manufacturing capacity, which will drive sustainable future growth."

Hikma's operations are divided into three operating divisions. I've included 2023 revenue and adjusted margins by each one to give an idea of scale.

Injectables (FY23: $1,203m / 36.9%): this business operates globally, including in the US where it has growing manufacturing capacity. Revenue growth is expected to be 6%-8% this year, with a core operating margin of 36%-37%.

Branded (FY23: $714m / 23.8%): this business sells generic and licensed medicines under various brand names. Key therapeutic areas include type two diabetes, multiple sclerosis and oncology.

The branded business is said to have had a strong start to the year but, currency headwinds are expected to reduce reported sales growth to "low-single digits".

Guidance for "slight growth" in core operating profit suggests margins will be fairly flat this year, but no explicit guidance was provided.

Generics ($937m / 20.5%): this business is said to be performing well and benefits from a "broad product portfolio and recent launches".

Hikma has just appointed a new president for the generics business, Hafrun Fridriksdottir. She is said to have 25 years of "deep pharmaceutical industry experience", with an emphasis on R&D and product launches.

Generics revenue is expected to rise by 3%-5% this year, but core operating margin is expected to fall to "mid-teens" due to an increase in certain royalty payments.

Dividend: Hikma's growing size and maturity appears to have prompted management to increase the payout ratio.

The total dividend rose by 29% to $0.72 per share last year, representing a 32% payout ratio.

Going forward, the target payout ratio will be increased from 20%-30% to 30%-40%. I reckon this should support a dividend yield that's comparable to those of GSK and AstraZeneca.

Broker forecasts: I don't have access to any updated broker notes for Hikma, but consensus forecasts I can see suggest earnings will fall slightly to around $2.05 per share this year (2023: $2.23 per share). The dividend is expected to remain flat.

These estimates price the stock on around 12 times forecast earnings, with a 3.1% yield.

My view

Hikma's growth hasn't always been consistent and the company has had a few problems over the years. However, the group's strategy has remained consistent and this business has created a lot of value for long-term shareholders.

Last year's results give the stock an EBIT/EV yield of just under 6%, by my calculations. That's not expensive, in my view.

Although reported profit margins dipped last year due to various factors, I think it's reasonable to expect some recovery over the next couple of years.

Historically, the best time to buy these shares has been when the share price has dropped close to NAV. But the current valuation doesn't look excessive to me, on a long-term view.

I'm interested in Hikma and have added this share to my watch list. That's three out of three this week, which is unusual!

As always, please let me know what you think of the stocks I've covered, or indeed any that I chose not to cover. Thanks for reading!

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.