Dividend notes: taking stock - SHEL, BME, RS1 (28/07/23)

I review the latest updates from Shell, B&M European Value Retail and RS Group and follow up concerns I've previously flagged up.

Welcome back to my dividend notes. Today I've revisited three companies I've commented on in recent months. Do new updates from these firms change the picture for me?

Companies covered:

- Shell (LON:SHEL) - with energy prices back to pre-2022 levels, profits are falling fast. Shell's cash performance remains excellent, but I think there will be better buying opportunities ahead.

- B&M European Value Retail (LON:BME) - the retailer has secured the services of trading boss Bobby Arora with a lucrative new retention deal. I'm glad B&M has been reading my notes!

- RS Group (LON:RS1) - a brief Q1 update reveals a weaker start to the year, but I remain a fan of this business, which is on my watch list.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Shell (SHEL)

"lower realised oil and gas prices, lower volumes, and lower refining margins"

Shell's profits fell by more than 50% during the second quarter, compared to the same period last year. The company reported adjusted earnings of $5.1bn for the period, compared to $11.5bn in Q2 2022, when oil and gas prices peaked.

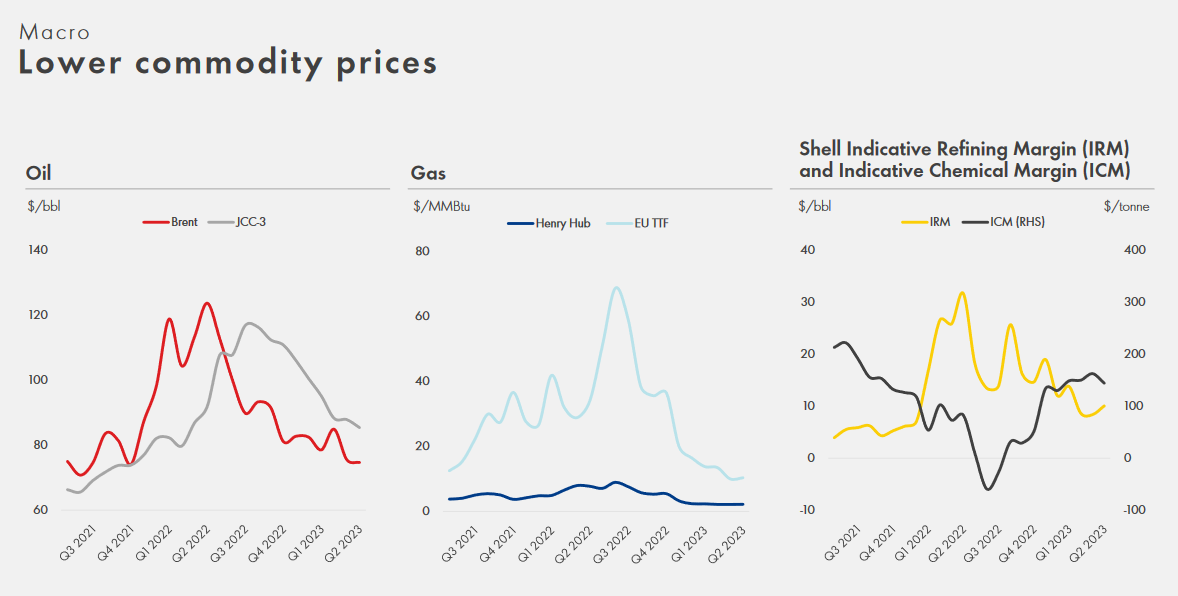

Oil and gas prices are all at comparable levels to before the invasion of Ukraine. Refinery margins have also returned to more normal levels, as this chart from Shell's Q2 presentation shows:

Taking a broader view, Shell's half-year results were still strong:

- Adjusted earnings: $14.7bn (-29% vs H1 2022)

- Free cash flow: $22.0bn (H1 2022: $23.0bn)

- Net debt: $40.3bn (H1 2022: $46.4bn)

- H1 dividend: $0.6185 (H1 2022: $0.50)

As I commented in my recent in-depth review of Shell, I've not seen the company's finances look this healthy for a long time. But although the current forecast P/E of 7 may seem temptingly cheap, I think it makes sense to consider a broader perspective when assessing such a cyclical business.

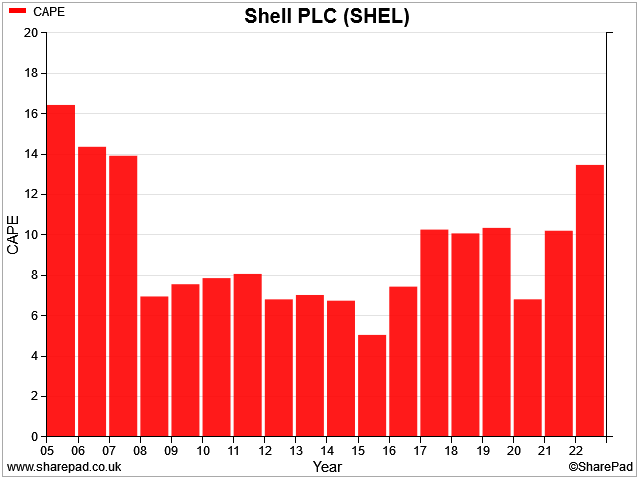

One metric I like to use in this scenario is the CAPE ratio (price/10-year avg earnings). SharePad data tells us that Shell still looks quite expensive on this metric, relative to historic levels:

My view

As I discussed in my piece last weekend, the bull case here might be that Shell's profitability is about to return to levels not seen since before 2008. I can't rule this out, but it's not something I'm willing to count on.

I think Shell remains a fundamentally mature, low-growth business that will – at some point – need to evolve its activities to reflect the realities of the energy transition.

Although Shell's forecast 4.6% dividend yield is well supported and looks very safe to me, I suspect there will be better buying opportunities ahead.

B & M European Value Retail (BME)

"Group Trading Director Retention Agreement"

B&M has agreed a new retention deal with its Group Trading Director Bobby Arora that could payout up to £16m over the next three years.

Arora is the brother of former CEO Simon Arora. The pair bought the business in 2004 and built it into its current form.

Bobby Arora's role as Group Trading Director means that he's ultimately responsible for all sourcing and ranging decisions. His judgement and skill in these areas has been a key element of B&M's long-running success.

When I wrote about B&M in May, I suggested that Bobby Arora represented a key-person risk. As a potential shareholder, I'd be concerned about his departure. Clearly, B&M's board are also concerned about this risk.

This new retention agreement will payout cash bonuses of up to £16m over the three years to the end of 25 March 2026, based on unspecified performance criteria. This is in addition to Bobby Arora's existing remuneration, which isn't disclosed.

The company have justified this retention agreement by saying that as he is not a board member, Bobby Arora has "historically not received a performance-based long term incentive plan award".

However, there's no escaping the generousity of this deal, which could pay out more than £5m per year. For context, former CEO Simon Arora's total remuneration in his last full year at B&M was £4.4m.

We don't know whether Bobby Arora would have left suddenly if he hadn't secured this deal. Perhaps. For now, I think this bonus scheme is probably money well spent, given the value Arora has helped to create over the last 20 years.

However, one obvious question for the board is whether Arora is planning to retire in 2026. In any case, I would hope that the company will plan carefully for a potential succession over the next three years in order to mitigate this risk.

RS Group (RS1)

"Like-for-like revenue declined 7% reflecting a more challenging environment"

I reviewed electronic component supplier RS Group's full-year results in May and earmarked the company as a potential investment, despite the uncertain outlook.

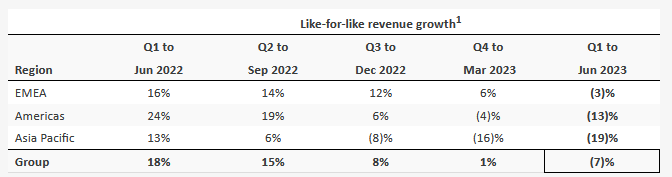

Last week's first-quarter update covered the three months to 30 June and confirms the company has seen trading slow:

- Total revenue down 2%, despite a 6% contribution from acquisitions

- Like-for-like revenue down by 7%

- Trading in EMEA and Americas was "softer than anticipated", while Asia Pacific was "volatile"

This chart shows the steadily weakening quarterly trend over the last 15 months:

My view

RS Group scores well in my dividend screen and boasts attractive quality metrics, with a long-term average return on equity above 20%.

The shares currently trade on around 13 times forecast earnings, with a 2.8% yield. While I don't think this is unreasonable, I'm hoping that any further weakness later this year could provide a more tempting buying opportunity.

For now, I remain on the sidelines.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.