Dividend notes: turnaround + stock overhang - MKS, RS1 (08/11/2023)

Half-year results from Marks and Spencer and RS Group provide a sharp contrast in performance.

Welcome back to my dividend notes.

Today I'm looking at an impressive turnaround story (I think) and an industrial firm that's suffering from an unfortunate stock hangover.

Companies covered:

- Marks and Spencer (LON:MKS) - the high street stalwart returns to the dividend list for the first time since 2019. Half-year results show a recovery in margins and improved cash generation. I'm impressed with this turnaround.

- RS Group (LON:RS1) - this electronic component supplier appears to be suffering with excess stock and an uncertain outlook. I remain on the sidelines, although I don't think there are any serious problems here.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Marks and Spencer (MKS)

"Restoration of dividend of 1p per share"

It wasn't so long ago that Marks and Spencer's turnaround seemed unlikely. But chief executive Stuart Machin appears to be succeeding where his predecessors have failed.

M&S's half-year results showed solid profit growth, positive cash generation and the resumption of dividend payments.

The 139-year-old retailer apparently regained its crown as the UK's largest womenswear retailer over the summer – a position it has not held for four years.

This isn't a stock I'd consider for my dividend portfolio at the moment, but M&S has had a good dividend record in the past. I think it's worth keeping an eye on the company's progress, now that payouts have restarted.

Results summary: revenue rose by 10.8% to £6,134m during the six months to 30 September, lifting pre-tax profit by 56.2% to £325.6m.

Operating margin for the half year was 5.1%, consistent with the 5.2% reported last year.

The company's measure of free cash flow from operations showed an inflow of £27.7m for the six months, compared to an outflow of almost £117m during the same period last year.

Looking at the cash flow statement, my sums suggest half-year free cash flow of £44.5m, compared to an outflow of £184m during H1 last year, excluding acquisitions. In either case, the trend appears to be positive.

This improvement helped to support a reduction in financial debt, which fell by £310m to £0.32bn during the half year. Including more than £2bn of lease liabilities, the company's reported net debt at the end of September was £2.6bn (H1 2022: £2.9bn).

Trading commentary: M&S Food has been an acceptable performer in recent years, but the company's Clothing & Home business has been struggling for almost as long as I can remember. This situation appears to be improving, with both divisions performing well during the half year.

- Food: total sales rose by 14.7%, with like-for-like (LFL) sales up 11.7%. M&S says it outperformed all the main supermarkets on volume thanks to increased customer numbers. An adjusted operating profit of £164.9m gives a credible operating margin of 4.3% (H1 2022: 2.2%) for this division, slightly above Tesco.

- Clothing & Home: sales rose by 5.7%, with LFL sales up 5.5%. Customer numbers increased and comments such as "more confident buying and further improvements in style perceptions" suggest that M&S is at last managing to make its ranges a little more appealing to shoppers. Operating profit rose by 30% to £223.4m. An improved operating margin of 12.1% (H1 2022: 9.8%) was supported by a reduction in discounting and lower supply chain costs.

Dividend: M&S has declared an interim dividend of 1.0p per share. Broker consensus estimates suggest a full-year payout of about 5p per share, giving a prospective yield of 2.2%.

Outlook: management say that momentum was maintained through October and they "are planning for a good Christmas".

However, factors such as higher interest rates and erratic weather mean that they "are not relying on the favourable recent market conditions persisting" into 2024.

As a result, profits are expected to be weighted towards the first half of the current year. This is a contrast to the last couple of years, but is more consistent with the group's pre-pandemic performances.

Consensus forecasts already seem to reflect this expectation – H1 adjusted earnings of 12.7p per share represent 66% of full-year estimates of 19.2p per share.

My view

Full-year forecasts price M&S shares on around 12 times earnings. That looks about right to me for the moment, given the company's cautious commentary on the year ahead.

Improved cash generation and margins look reassuring to me, but I'd imagine M&S will continue to face tough competition from rivals such as retailer Next and the main supermarkets.

Although M&S's brand proposition does seem to be holding up well, I would guess that any further margin gains will be tougher to achieve. That would leave the group reliant on sales growth alone, which I'd expect to be slower.

I'm going to remain an interested observer for now. But if CEO Stuart Machin can continue to deliver, I think this could be one of the more impressive big cap turnarounds in recent years.

RS Group (RS1)

"RS has delivered a resilient performance in difficult markets, which have been more challenging than anticipated at the beginning of the year"

I've looked at this FTSE 250-listed electronic component supplier twice this year (in May and July), noting the falling share price and historically strong quality metrics.

The company has also risen (fallen?) to become one of the top-ranked shares in my dividend screen results.

However, with the outlook seemingly deteriorating, I've opted to stay on the sidelines.

This week's half-year results provided an opportunity for the company to provide a more concrete view on progress and the near-term outlook.

Unfortunately, the picture seems to remain uncertain. The company also seems to have been caught with excess inventory at just the wrong time, as I'll discuss below.

Here's a quick review of RS Group's half-year results, which cover the six months to 30 September 2023.

Results summary: falling sales volumes hit profits and margins during the quarter, demonstrating what happens when operating leverage goes into reverse.

RS Group's revenue fell by 1% on a reported basis or 8% like-for-like to £1,447m. However, pre-tax profit dropped by 31% to £126m.

Although gross margin was relatively stable at 43.7% (-0.4% LFL), the group's operating margin – which includes a much wider range of costs – fell to 9.6% (H1 22/23: 12.8%). The company says employee costs were a significant factor, with "a mid-single digit pay increase" awarded across the group during the period.

My sums suggest that free cash flow for the half year was just £11m (H1 22/23: £102.6m).

The main reason for this seems to be a sharp rise in unsold stock. RS says its gross inventories rose by £139m to £799m during the half year (FY22/23: £660m).

Of this, £74m relates to the acquisition of Distrelec in July. The remaining £65m of additional inventory has come from the easing of supply chain issues. This means suppliers are now fulfilling new orders more quickly, including items previously on long lead times.

Inventory strength worked in RS's favour during the supply chain crisis, when rivals were strugging to get stock. But it now seems to be backfiring. My impression is that RS has over-ordered and is now stuck with excess stock:

"Inventory provisions have increased by £35 million to £79 million since the year end, £23 million due to the acquisition of Distrelec as expected and the balance due to the continued sales slowdown pushing inventory into excess, particularly of electronics products where minimum order quantities are high."

I'm surprised to see that almost one third of stock acquired with Distrelec was already expected to be impaired. This business is a similar firm that was acquired for €365m acquisition to expand RS's market presence in Germany, Switzerland and Sweden.

At the time of the acquisition, in April, management said that the Distrelec deal would create "material cost synergies including procurement, logistic and warehousing". My impression now is that it could take longer for these to feed through, given the level of excess stock now being held by the combined group.

The acquisition of Distrelec also contributed to a sharp rise in net debt. The balance sheet has moved from a net cash position of £3m one year ago to a net debt of £502m today. While this does not look problematic in itself, it's a further pressure on cash flow, with net finance costs expected to rise to £30m in this financial year (FY23: £12.2m).

Dividend: the interim dividend has been increased by 15% to 8.3p per share. However, broker consensus forecasts I can see suggest a full-year payout of 21.1p per share, almost unchanged from 20.9p last year.

This suggests to me that the final dividend might be cut, or more likely held flat. I estimate a forecast yield of around 3.1%, at current levels.

Outlook: disappointingly, these results did not include any updated guidance for the current year. However, commentary from CEO Simon Pryce did not sound all that positive to me on a near-term view:

"Whilst markets remain difficult in the short term, the medium and longer-term growth characteristics are attractive."

City analysts – at least some of whom will have been briefed by new CFO Kate Ringrose – appear to have trimmed their forecasts slightly for FY24 and FY25, but not made any major changes.

A cost-cutting programme has been launched. This is expected to deliver annualised savings of "over £30m" by 2025, at a cost of £15m.

Adjusted earnings for H1 were 22.3p per share, while consensus estimates for the full year are for earnings of 53p per share. This suggests a significant second-half weighting (Oct-Mar), which would be in keeping with recent years.

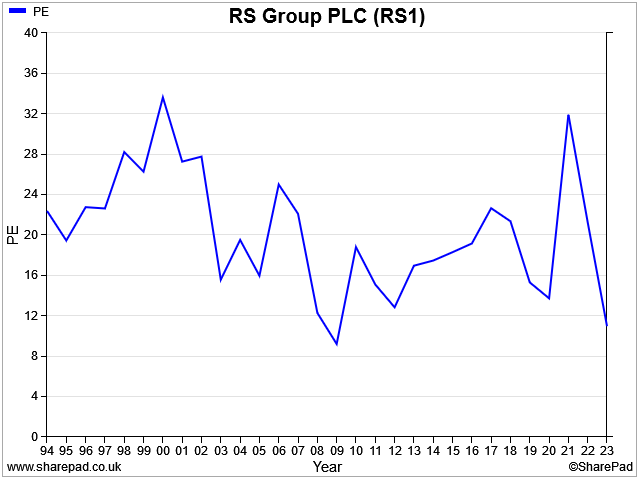

These forecasts put RS shares on a forecast P/E of 13. That's below average but perhaps appropriate for this more difficult period.

My view

Assuming that the economic outlook doesn't get too much worse, I would guess that RS shares could be quite reasonably priced at under 700p. The last time the company's P/E ratio was this low was in 2009/10, according to SharePad.

However, given the lack of clarity over the outlook and the group's substantial stock overhang, I don't see any need to rush in here. I intend to stay on the sidelines and await further news.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.