Dividend notes: short and sweet - MGNS, LTHM, MGAM, BME

29/06/23: I review news and updates from Morgan Sindall, B&M European Value Retail, James Latham, and Morgan Advanced Materials.

Welcome back to my dividend notes. Today I'm covering some short-but-positive updates from companies I've mentioned before in these pages.

I'll also take a look full-year results from a company I think is one of the best businesses on the AIM market.

Companies covered:

- Morgan Sindall (LON:MGNS) - this construction group has increased its full-year profit guidance following a strong performance from its Fit Out business. I'm a fan, but remain on the sidelines.

- James Latham (LON:LTHM) - an excellent and transparent set of results from this family-led AIM firm. I'm uncertain about the near-term outlook but would be happy to own shares in this business.

- Morgan Advanced Materials (LON:MGAM) - half-year update confirms full-year expectations, but I wonder about the group's historic lack of growth. I'm positive, but would need to do more research to form a strong view.

- B&M European Value Retail (LON:BME) - solid Q1 revenue growth but no change to full-year guidance. The market seems disappointed and I agree that the share price looks up with events, despite my liking for the business.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Morgan Sindall (MGNS)

"the Board now expects full year profit for the Group to be ahead of its previous expectations"

A short-but-sweet update from this FTSE 250 construction and infrastructure group, which has upgraded full-year profits forecasts.

Trading update: the company says that its Fit Out division – which fits out office buildings – is performing well and is expected to report half-year profits 40% above last year.

Management have previously guided for a weaker second half, but the order book now appears to be a little stronger than expected.

As a result, Morgan Sindall's full-year profits are now expected to be ahead of previous expectations.

No explicit financial guidance is provided today, but I'd guess that this wording might suggest earnings c.5% above previous forecasts.

Based on consensus earnings estimates of 222.9p per share in SharePad, I guess this might suggest earnings of c.235p per share this year. That would put the stock on a forecast P/E of less than eight, with a dividend yield nearing 6%.

My view: I've previously covered Morgan Sindall in an in-depth dividend share review and, more recently, in a dividend note in May.

Despite my general prejudice against construction and contracting firms, I'm a big fan of this founder-led business.

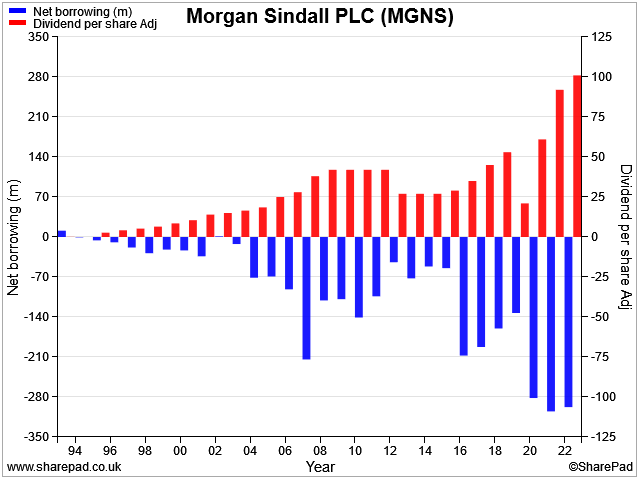

I think it's very well run, with a strong balance sheet and an impressive dividend track record:

Morgan Sindall scores highly in my dividend screen and currently offers a forecast dividend yield of 5.9%. This payout looks well supported to me, especially after today's news.

However, the reaction to today's news has been muted. This suggests to me that the market may share some of my concerns about the broader cyclical risks here, especially as they relate to the impact of higher interest rates.

Despite these concerns, I can't shake off a niggling feeling that I probably should own this share in my dividend portfolio. Even so, I'll probably stay on the sidelines for now.

James Latham (LTHM)

"The Board has declared a final dividend of 20.8p per Ordinary Share (2022: 19.0p) plus a special dividend of 8.0p (2022: 8.0p) to reflect the exceptional performances both this year and the previous year."

James Latham is one of the UK's largest timber merchants, supplying builders merchants, contractors and a wide range of other trade customers. The firm is chaired by family member and former chief executive Nick Latham.

The group was founded more than 250 years ago and first floated on the UK stock market in 1965, making it one of the older members of today's cohort.

Latham is listed on the AIM market but boasts quality metrics and a consistency of performance that would shame many higher-profile main market businesses.

Today's results are typical of the straightforward and transparent reporting provided by this family business. Management commentary is concise, while the accounts are free of adjustments and other face-saving metrics.

To its credit, the company doesn't try to hide the fact that profits over the last two years have been exceptional and may not be entirely sustainable.

Results summary: supply chain conditions are said to have eased last year and gradually returned to normal. Unsurprisingly, rising energy costs affected Latham's operations.

More broadly, management said that while like-for-like sales volumes rose by 5.3%, they saw some customers trading down to cheaper products.

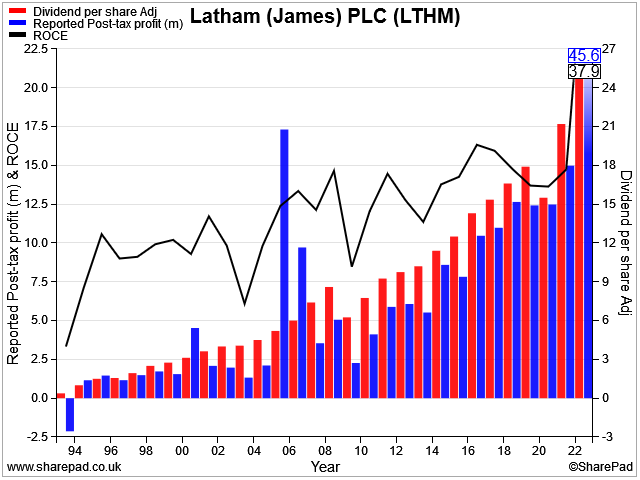

None of this prevented Latham from delivering another strong set of numbers, with profitability well above historic norms.

Revenue for the year rose by 6% to £408.4m, mirroring a 6.5% average increase in the cost price of the group's stock. Pre-tax profit fell by 23% to £44.5m, reflecting broader cost pressures.

Shareholders will receive a final dividend of 20.8p per share and a special dividend of 8p, giving a total payout for the year of 36.05p per share. That's equivalent to a yield of 2.8% at the time of writing.

This payout is comfortably supported by net cash, which rose to £62.6m last year (FY22: £37m). This increase was driven by cash released as inventories were reduced to more normal levels.

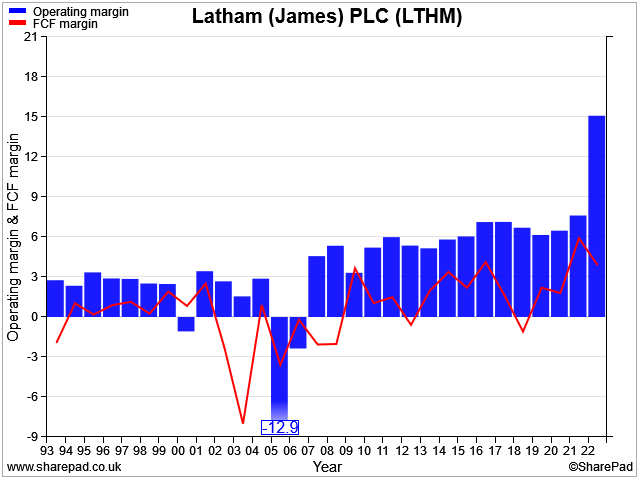

My sums show free cash flow of £32m for the year, giving a free cash flow margin on revenue of 7.9%, just below last year's operating margin of 10.7%. Both figures are above the historic norm for the business, reflecting favourable trading conditions and the benefit of last year's inventory unwind:

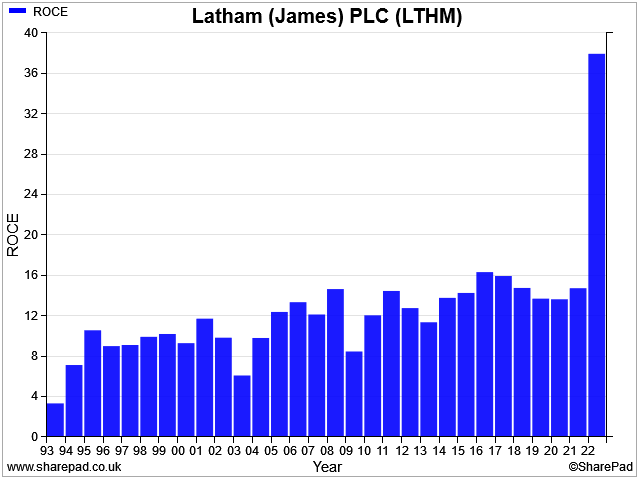

Distribution businesses are inherently low margin, due to the large pass-through element of their revenue. In my opinion, distributors' profitability is generally better reflected by return on capital employed.

My sums suggest James Latham generated ROCE of 23% last year. This is down from the 35%+ level reported in 2022, but significantly above the medium-term average of c.15%:

It's worth pointing out that Latham's pension schemes absorbed £4m of cash flow last year – a significant amount.

My reading of last year's annual report suggests that payments may fall from 2024. But in contrast to many (most?) firms, Latham's final salary pension scheme still appears to be active and has merely closed to new entrants. So pension contributions could remain higher than they might be elsewhere. I don't see this as a serious concern though – it's affordable and may help with the retention of experienced staff.

Current trading & outlook: when supply chain problems peaked in 2021 and 2022, James Latham gained pricing power by being able to fulfill orders from stock when its rivals could not.

This advantage now appears to be easing – the company says that it's now seeing "a more competitive market place", albeit pricing is still well ahead of pre-pandemic levels.

While some customers are trading down to cheaper products, volumes have continued to increase this year.

One concern flagged by the business is that the market in Europe is quiet. Management suggest that this might lead European manufacturers to export cheaper product into the UK market, putting pressure on prices.

With admirable honesty (I think), the company admits its main focus is now on navigating a return to normal levels of profit in more difficult market conditions:

"The board's challenge is to navigate the business towards what is a more normal and realistic profit achievement which takes into account the market conditions we are operating in and the inflationary overhead pressures that all companies are facing."

My view: today's results confirm my view that this is an high-quality and well-run business. Based on recent profits, the shares appear exceptionally cheap to me – today's results show a trailing free cash flow yield of 15%.

The stock's forecast P/E of eight is also modest, although the dividend yield of 2.8% is less obviously cheap, due to a conservative payout policy. Dividend cover is normally c.3x in more normal times.

However, I think it's prudent to price in a further decline in profits. The problem is, I don't have any idea at all how much further – if at all – Latham's profits may fall.

James Latham scores well in my screening and I'd be happy to own the shares at some point. For now, it's on the watch list.

Morgan Advanced Materials (MGAM)

"There has been no change in the Board's expectations for the full year, with organic revenue growth expected to be 2-4%."

In April I looked at full-year results from Morgan Advanced Materials, which produces thermal ceramics used in industrial applications.

My overall impression was positive, although I felt some caution about cyclical risks to demand.

H1 trading update: today's update covers the six months to June 2023 and confirms revenue is expected to be 2% higher, on an organic basis (i.e. comparable to last year).

Outlook: full-year expectations are unchanged, with organic revenue growth expected to be 2%-4%. With inflation running at c.8%, that suggests to me that volume growth could be minimal.

Broker consensus forecasts in SharePad suggest adjusted earnings of 26.4p per share, with a dividend of 11.5p. At a last-seen price of 270p, that values Morgan Advanced on 10 times forecast earnings, with a 4.2% dividend yield.

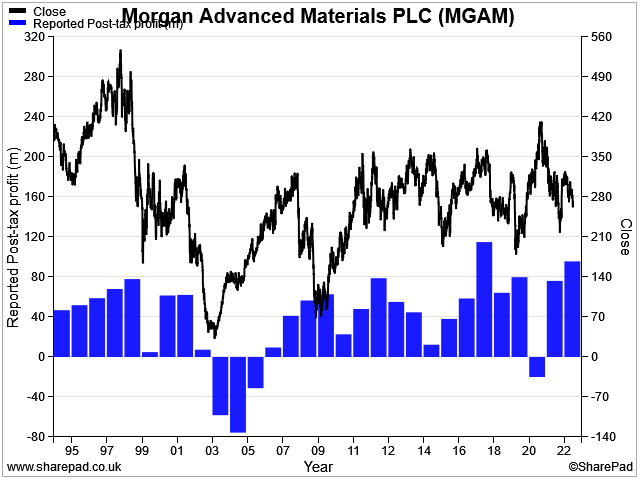

My view: I remain positive about this business, which looks quite reasonably priced to me. However, I can't completely ignore the macroeconomic headwinds, nor the reality that profits (and the share price) have made little real progress over the last decade:

I'd need to do more research to understand the reasons for the firm's flat performance – and whether the near-term future is likely to be different.

B & M European Value Retail (BME)

"Group revenue growth in Q1 of 13.5%, in line with our internal expectations"

Today's first-quarter update from value retailer B&M appears to confirm the firm's view that last year's results (which I covered here) can be seen as a new baseline for growth.

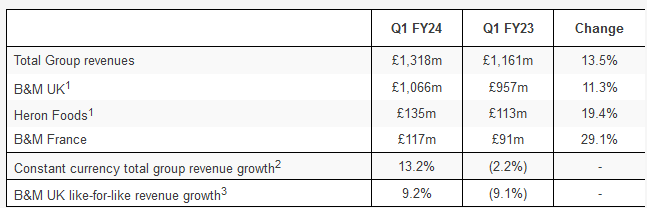

B&M says that group revenue rose by 13.5% to £1,318m during the period, with UK sales up by 9.2% on a like-for-like basis. That seems positive to me, even if it is only slightly ahead of inflation.

Elsewhere, the group's smaller businesses are also continuing to deliver double-digit sales growth:

Outlook: first-quarter trading is said to have been "in line with out internal expectations". There's no other comment on outlook today, so I assume that full-year expectations remain unchanged at this point.

Consensus forecasts suggest adjusted earnings of 36.7p per share this year, broadly unchanged from last year's figure of 36.5p per share. That's equivalent to 15 times forecast earings.

Dividend forecasts for this year seem to suggest an ordinary payout of 15.8p per share (FY22: 14.6p) plus a possible 4p special dividend (FY22: 20p). These estimates imply a dividend yield of around 3.3%.

My view: I notice the shares are down by 6% on the day as I write – presumably this reflects a degree of profit taking and – perhaps – disappointment at the lack of an upgrade to guidance.

Given the slower pace of earnings growth forecast for FY24 and FY25, I would say the shares are probably up with events at the moment.

However, I remain positive about this business, which is more profitable than UK supermarkets and most other big listed retailers, such as Halfords and Pets at Home.

If B&M shares were to pull back below 450p again, I might be quite tempted.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.