Portfolio shares: Why I'm buying Homeserve

Roland explains why he's decided to add Homeserve shares to his quality dividend model portfolio.

A combination of unforeseen events and mistakes mean that my 20-stock quality dividend model portfolio has been reduced to 17 stocks in the space of a month. Although I don't plan to be too dogmatic about maintaining the portfolio exactly at 20 stocks, I do plan to replace (probably) all three of these shares over the next few weeks.

As a quick reminder, the departed companies are:

- Air Partner (LON: AIR) - sale report here

- Polymetal International (LON: POLY) - sale report here

- Central Asia Metals (LON: CAML) - sale report here

This week I want to look at the first of these replacements shares. Homeserve (LON: HSV) is probably a company that many UK investors are familiar with through its business providing home emergency insurance for burst pipes and similar problems. This is typically sold through partnerships with water utilities.

This business still exists, but Homeserve is a much broader and more global business today. The company's stated purpose is "making home repairs and improvements easy" and the group now generates around 60 % of its profits in North America. In addition to the UK, Homeserve is also present in Japan and much of western Europe.

Globally, Homeserve has two main product lines:

- Membership and HVAC (heating, ventilation and air conditioning)

- Home Experts (eLocal in the USA, Checkatrade in the UK)

Membership and HVAC: Homeserve was founders by CEO Richard Harpin in 1993 as a joint venture with South Staffs Water. The UK membership business can be traced back to this time, while the US business was launched in 2003.

Membership services are similar to insurance and allow customers to take out policies to provide protection from plumbing and HVAC problems. Homeserve also covers areas such as electrical problems and pest control in some markets.

Homeserve now has 4.8m customers in North American, with 1.5m in the UK. France and Spain have 2m between them. In recent years, the US business has grown strongly but the UK has underperformed, losing customers and reporting falling profits.

Efforts are being made to turnaround the UK business. These include partnerships with energy suppliers E.On and Shell Energy, digitising customer interactions, and the recent acquisition of CET Structures, a rival UK home emergency assistance business.

I'm not sure how much scope the UK membership services market has to recover and expand. But I feel progress in the US alone supports a confident view on this business.

Homeserve's membership proposition appeals to a certain percentage of customers. But others – like me – will never be buyers. This is where the group's Home Experts business comes into play.

Home Experts: The home repair and improvement market is typically quite fragmented. A sizeable share of the market is held by independent tradespeople who tend to operate by phone and recommendation. Although this approach can work well, common issues are inconsistent pricing, variable service quality and erratic availability.

Homeserve's Home Expert business is an attempt to bring this business online through a trusted marketplace that offers user reviews, messaging options, and search and quote facilities.

In the UK, Homeserve's brand is Checkatrade, which I think is fairly well known. In the US, the group has eLocal, which is somewhat larger. Homeserve charges a subscription fee for listing on its these websites.

eLocal generated revenue of £48.5m and an operating profit of £6.1m during the first half of the current year.

Checkatrade is being developed based on lessons learned from the more mature eLocal business. This is delivering results. Checkatrade's operating loss shrunk to just £0.2m during H1, and this business seems likely to become profitable soon.

Management: I'll come onto Homeserve's numbers in a moment. But first I'd like to take a look at the group's management. Founder Richard Turpin remains CEO of Homeserve, with a 12% shareholding worth £270m at the time of writing.

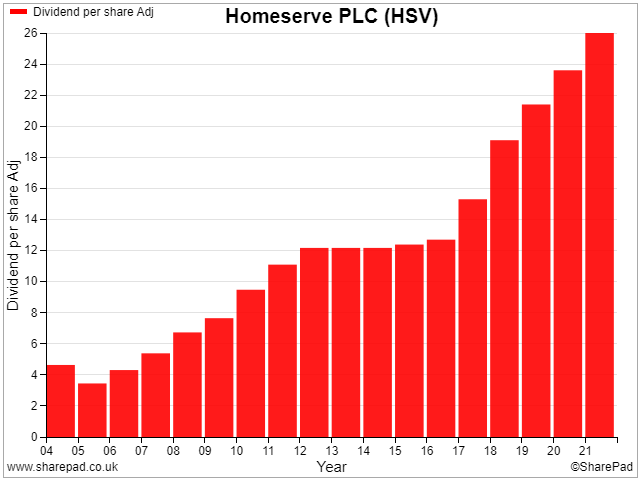

Since spinning out the business from South Staffs Water and floating it in 2004, Homeserve shares have delivered a capital return in excess of 400%. The dividend has risen from 3p to 26p over this period and has only been cut once since 2005.

A further management attraction, for me, is the recent appointment of Tommy Breen as chairman. Breen's previous role was as chief executive of DCC, which is also a member of my model portfolio (disclosure: I hold DCC).

Mr Breen was CEO of DCC for nine years until 2017 and had a 30-year career at the Irish firm. During Breen's time in charge, DCC's revenue rose from £5.9bn to £12.3bn. DCC's net profits doubled from £108m to £203m over the same period.

I'm encouraged by the appointment of Mr Breen as chair. I'm also encouraged to see that he spent £922,000 buying Homeserve shares last year.

Homeserve: crunching the numbers

Description: Homeserve offers a range of home repair and improvement services and operates online platforms connecting independent tradespeople to consumers.

| Homeserve (LON: HSV) | Quality Dividend score: 79/100 | Forecast yield: 4.3% |

| Share price: 680p | Market cap: £2.3bn | All data at 17 March 2022 |

Latest accounts: Half-year report for six months ending 30 September 2021.

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain why I've chosen Homeserve to be one of the replacement stocks for the model portfolio. Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Note: For the purposes of this review, I'm going to classify Homeserve as a financial stock. That's how it's classified by SharePad and indeed the FT. This means I'll be using the financial version of my screen. (I explained why I have financial and non-financial versions of my screen in last week's article.)

Dividend culture: very strong

It's great to kick off with a simple clean metric. I measure dividend culture by the number of consecutive years that a company has paid a dividend, even if it's been cut in that time.

Homeserve has paid a dividend every year since at least 1995, giving it a 27-year streak. According to SharePad, the payout was cut modestly in 2005 after the group was spun out of South Staffs Water. Otherwise, there haven't been any reductions. It's an impressive record.

Homeserve scores 5/5 for dividend culture in my screening system.

Dividend safety: impeccable

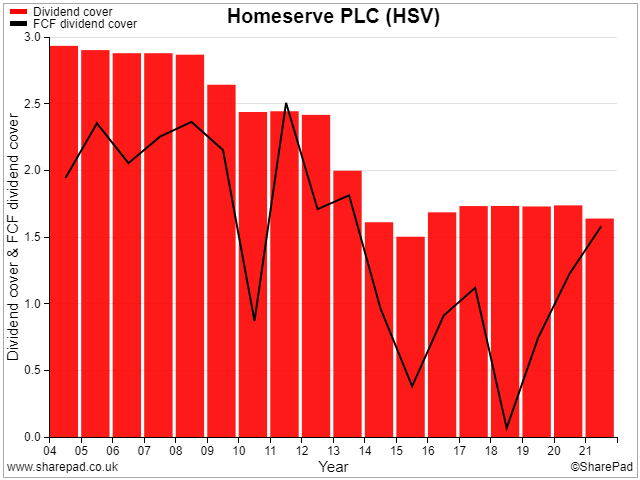

I rate dividend safety using by looking at the payout ratio as a percentage of earnings. However, free cash flow cover is also important. Ultimately, I want my dividends to come from surplus cash.

Homeserve scores well on both counts, as we can see from this chart:

Interestingly, this chart highlights why I only check for dividend cover by earnings in my screen, not free cash flow. Homeserve has an excellent record of free cash flow in my view, but free cash flow is often lumpy for growing businesses, as they invest in expansion. I think that's what we can see here.

The level of dividend cover has reduced over the last decade, but I'd say this is consistent with the greater size and maturity of the business.

Overall, I'm very comfortable with the safety of Homeserve's dividend.

Homeserve scores 5/5 for dividend safety in my screening system.

Dividend growth: healthy

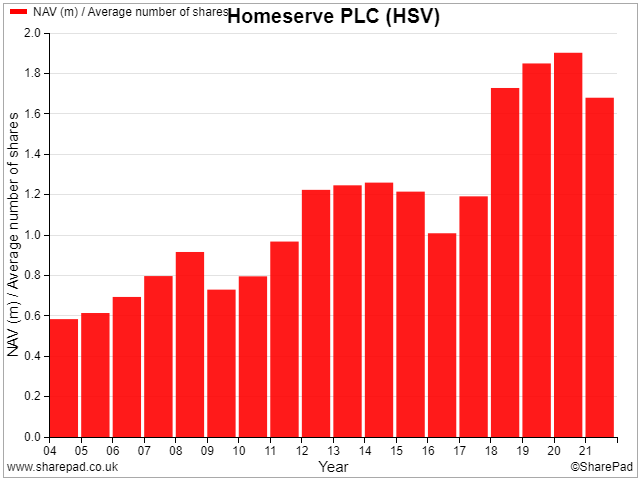

To score stocks for dividend growth in my financial screen, I use a weighted blend of five-year average dividend growth and five year net asset value per share (NAVps) growth.

We've already seen that the group's dividend growth has been strong in recent years. But what about NAVps growth?

I use NAVps to test whether a financial firm is creating or destroying value for shareholders. This is possibly one area where the use of my financial screen is less appropriate for Homeserve, as its balance sheet isn't quite like that of an insurer, for example.

Even so, I think it's a useful check. Homeserve's net asset value per share has in fact risen strongly over the years. Just not in a straight line:

The recent dip means that Homeserve doesn't score quite so highly for NAVps growth as it does for dividend growth. Even so, the shares manage a credible score in my system.

Homeserve scores 3./5 for dividend growth in my screening system.

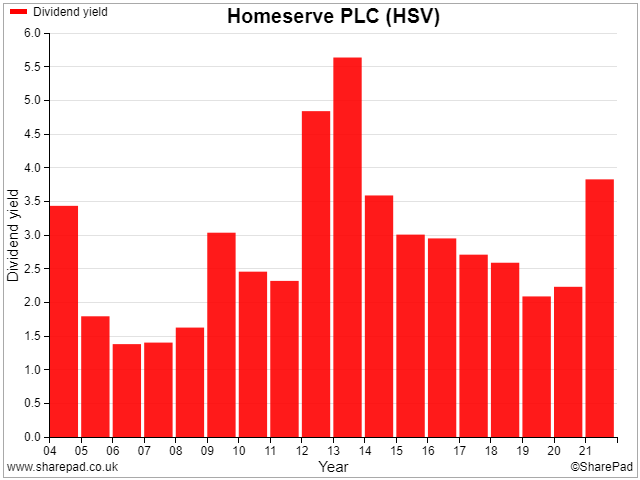

Dividend yield: above average

Homeserve is not a share that's often come onto my high yield screens. However, the chart below shows that there have been opportunities to buy the stock at above-average yield over the years.

I think right now could be one such opportunity. Homeserve's forecast yield of 4.3% is well above the level seen in recent years and looks attractive to me, given the company's dividend track record.

Homeserve's recent history of lower yields means it doesn't score all that well for yield in my screen at the moment. But I think this payout looks appealing at current levels.

Homeserve scores 2.3/5 for dividend yield in my screening system.

Profitability: high

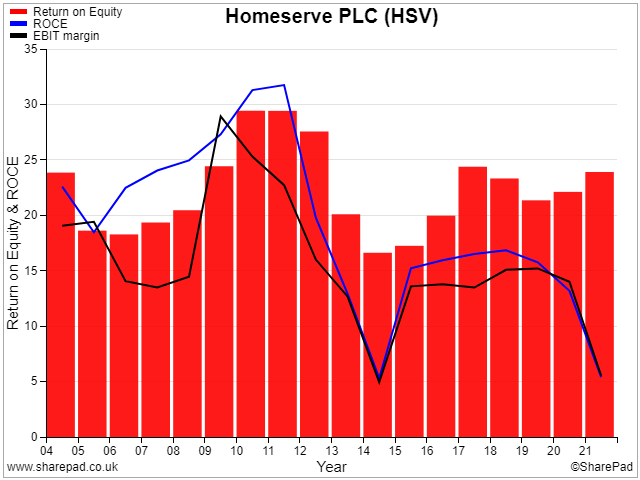

Homeserve has historically enjoyed double-digit operating margins and returns on equity. Although the company's statutory profits dipped during the pandemic year, I expect profitability to be restored in FY22 and certainly FY23.

The group's strong profitability supports what we've seen already – steady NAV and dividend growth over many years. Clearly, this has been a successful business over a long period.

I suspect that on reason why ROCE has fallen below return on equity in recent years is Homeserve's increased leverage. Debt will lift ROE while supressing ROCE. This is because ROCE is calculated based a company's debt and equity capital. ROE only includes equity capital.

Increasing debt will magnify returns on equity, at the expense (typically) of higher risk. This is a key element of the private equity playbook; wafer thin equity and lots of debt.

Homeserve scores 5/5 for profitability in my screening system.

Leverage: higher than I'd like

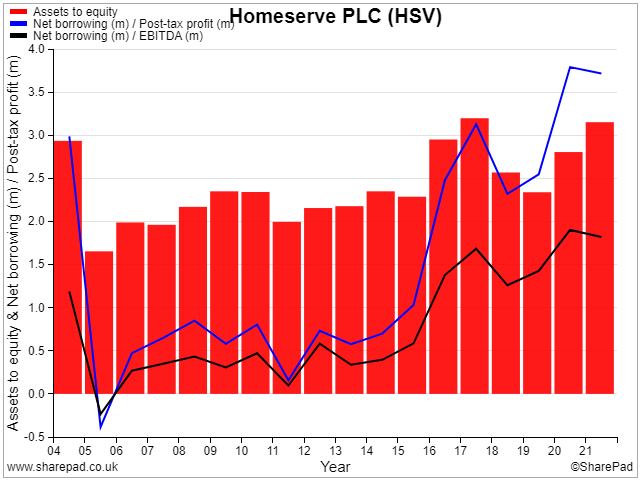

One of the differences with the financial version of my stock screen is that it uses the ratio of assets to equity as a measure of leverage, instead of net debt. I discussed this in more detail last week.

In Homeserve's case, I think it makes sense to look at debt in a more conventional way too, so here's a chart that tells a more complete story.

Let me break this down a bit. We've seen a steady increase in borrowing and leverage since 2016 as Homeserve has invested in the Home Experts platforms and the US business. However, although leverage has risen, I don't think it's out of hand.

The red bars show us the ratio of assets to equity. This has hovered between 2.0x and 2.5x in recent years, except over the last 18 months. As a rule of thumb, in most businesses, I prefer not to see this ratio get too far above 2.0x.

Similarly, the group's net debt/net profit ratio (blue line) has generally been reassuringly low. However, a steady increase in borrowing since 2016 has left the net debt/profit ratio close to my preferred maximum of 4.0x.

Using the more conventional net debt/EBITDA ratio (black line), Homeserve reported leverage of 2.1x at the half-year mark. I prefer to see this metric limited to 2.0x, but for profitable, cash-generative businesses I can accept a little more.

Fortunately, Homeserve's own policy is to keep leverage between 1.0x and 2.0x EBITDA, except for short periods. I expect to see a moderate reduction over the coming year as profits recover.

Reflecting this mixed picture, Homeserve scores 3/5 for leverage in my screening system.

Conclusion: I'm feeling positive

After scoring a stock on all of these criteria, my screening system weights, sums and normalises these scores to give a total out of 100.

Homeserve earns an overall score of 79/100 in my dividend screening system at the time of writing (March 2022). This puts it in the top 5% of UK stocks which currently qualify for my screen.

The obvious risk with Homeserve, in my view, is that the business could go ex-growth. This could lead to a prolonged period of lacklustre performance, potentially made worse by costly failed attempts to reignite growth.

I don't think this is likely just yet. The growth of the US business in recent years, plus more recent steps taken in the UK and Europe have convinced me that this business still has room to evolve and expand.

I'm also encouraged by the progress of the Home Experts platforms, although I don't know how likely it is that they'll ever become equal contributors to earnings with the core membership division.

CEO Richard Harpin has built a FTSE 250 company from the ground up, and continues to have a material shareholding. I think the arrival of Tommy Breen as chairman last year should give Harpin the partner he might need to take the group to the next level of its development.

Although Homeserve's leverage is a little higher than I'd like to see, my sums suggest we should see profits rise and leverage fall over the coming 18 months.

Decision: I'm going to add Homeserve shares to the quality dividend model portfolio. In line with my policy for selling and replacing shares, I'll add them to the model portfolio at the start of the next quarter.

I'll also be adding Homeserve shares to my own personal holdings, at some point after this article has been published.

For the avoidance of doubt, I do not currently hold Homeserve shares.

To make sure you don't miss out on future articles, please hit subscribe to receive all my posts by email and gain access to member-only areas of the site.

I'll be adding a comment facility to this site as soon as I'm able to; I look forward to your feedback over the coming months. In the meantime, you can always reach me on Twitter @rolandhead or by email.

Disclaimer: This is a personal blog. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.