Dividend notes: this 8% yield looks safe to me - SXS, TCAP (31/10/23)

I review third-quarter updates from FTSE 250 precision engineer Spectris and financial firm TP ICAP, which has an 8% dividend yield.

In this edition of dividend notes, I'm revisiting two companies that have just issued positive third-quarter updates.

I think much of the risk is probably in the price at both firms, although I can still see some potential concerns.

Companies covered

- Spectris (LON:SXS) - a solid Q3 statement from this FTSE 250 engineer, with updated guidance for adjusted profits towards the upper end of expectations

- TP ICAP (LON:TCAP) - this interdealer broker is trading in line with expectations but remains stubbornly cheap. I explain why I'm still on the fence, despite a tempting 8% yield.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Spectris (SXS)

"full year operating profit expected to be in the top half of guidance range"

When I wrote about FTSE 250 precision measurement specialist Spectris in April, I said the business looked good, but the shares were too expensive for me.

Step forward six months, and Spectris's share price has fallen by over 15% to around £31 per share:

The company's third-quarter update reads fairly positively to me. Should I be taking a closer look at this British engineer?

Q3 highlights: Spectris kicked off its third-quarter statement by updating its full-year guidance to suggest that adjusted operating profit will be "in the upper half of our guidance range of £250m - £265m".

My sums suggest that implies an adjusted operating margin of around 17%-18%.

The company's trading commentary also seems pretty reassuring to me:

- Q3 like-for-like (LFL) sales up 11%

- Year-to-date LFL sales up 16%,

- YTD book-to-bill of 0.97x (i.e. new orders are running at 97% of completed orders)

- Customer demand has now "broadly normalised" with backlog and lead times returning to "more typical levels"

- "strong progress" on profit margins; presumably this means they have improved

- Net cash of £164m at the end of September 2023

- Full-year sales now expected to be up by 10% LFL

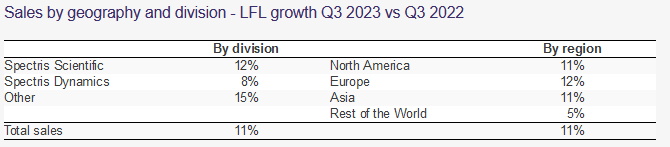

Sales growth appears to have been fairly broad based across the group's operating divisions and geographic markets:

Outlook: chief executive Andrew Heath says that he is confident in guidance for 2023 and expects "another year of progress in 2024".

Brokler forecasts suggest earnings of 195p per share this year, rising by 6% to 207p per share in 2024.

Those estimates price the stock on 15.5x 2023 earnings falling to a multiple of 14.5x for 2024.

The dividend – which has an unbroken 30-year growth record – is expected to rise by 7% this year and slightly less next year, giving a prospective yield of around 2.8%.

My view

I think Spectris is a good quality business and the shares score fairly well in my dividend screen at the moment.

However, I think it is worth flagging up that this business tends to apply fairly substantial adjustments to its annual results.

In each of the last two years, adjustments to operating profit have added more than 25% to the group's reported operating profit. This has had the effect of reducing the company's reported operating margin to around 13%, versus an adjusted figure of c.17%.

Many of the adjustments applied look like business-as-usual spend to me. Examples include IT project costs, restructuring and acquisition-related items.

As regular readers will know, I prefer to take a more conservative approach and rely on reported profits, rather than company-adjusted figures.

Assuming a similar level of profit adjustments in 2023, I estimate Spectris could report a statutory operating profit of perhaps £205m for 2023. That would give the stock an EBIT/EV yield of around 7%, which looks fairly reasonable to me.

Although the dividend yield here is a little low for me, at under 3%, I think it's the kind of quality business that could fit well into my portfolio. It's also worth remembering that Spectris has increased its dividend every year for the last 30 years. Such quality has a price.

This Q3 update outlook looks broadly reassuring to me, although I think there's still some risk that growth will remain sluggish as the boost from unwinding the backlog fades.

For now, I'll continue to watch closely and have added the shares to my watch list.

TP ICAP (TCAP)

"The Group continues to trade in line with the Board's expectations."

A short third-quarter update from this interdealer broker caught my eye today.

TP ICAP describes itself as a "world leading liquidity and data solutions specialist" and has a market share of more than 40% in its core over-the-counter (OTC) business.

What this means is that the company's broker teams institutional buyers and sellers of assets that are not listed on an exchange (hence OTC). These days, TP ICAP's services also include data and analytics products and a lower-touch execution venue, Liquidnet.

I've covered this business before, in an in-depth review in May '22 and earlier this year, when I looked at TP ICAP's Q1 update.

I'm intrigued by the low valuation, 8% dividend yield and seeming potential for strong profitability and cash generation. But a re-rating has been elusive so far and the firm is to some extent a hostage to market conditions.

Q3 update: TP ICAP's results for the first nine months of the year don't seem very conclusive to me, reflecting external market conditions rather than any clear underlying growth trends:

- YTD group revenue +2% to £1,644m

- Global Broking revenue: -1%

- Energy & Commodities: +16%

- Liquidnet: -3%

- Parameta Solutions: +5%

Outlook: management say the company is continuing "to trade in line with the Board's expectations".

Broker consensus forecasts I can see suggest adjusted earnings will rise by 3% to 25.7p per share this year, putting the stock on a forecast P/E of 6.5.

A total dividend of 13.2p per share is expected, which would give a tempting and apparently well covered 8% yield.

My view

TP ICAP appears to be trading stably and managing – if not reversing – the structural decline in OTC trade versus electronic venues.

However, the business has relatively high remuneration costs (broker bonuses) and it isn't yet clear to me whether it can generate sustainable growth from its non-broking divisions.

My podcast colleague (and former banking analyst) Bruce Packard has written extensively about TP ICAP on the ShareScope website, so I'd recommend taking a look at his comments if you'd like to learn more about this business.

I don't think I understand enough to take a position here, but my feeling is that the shares probably do offer value at current levels and could prove to be an interesting high-yield pick.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.