Dividend notes: a hidden profit warning? TCAP, SVS, SMIN

Positive results from two companies, but is there a hidden profit warning here? I review the latest updates from TP ICAP, Savills and Smiths Group.

Welcome back to my dividend notes. Today I'm going to take a brief look at some trading updates from the past week that have caught my interest.

Companies covered

- TP ICAP (LON:TCAP) - Q1 performance was aided by currency tailwinds but looks pretty reasonable. A difficult business for outsiders to understand, but still looks cheap to me, with a tempting 7.9% yield.

- Savills (LON:SVS) - was this week's AGM update a profit warning in disguise? I think it's pretty likely, but I remain positive about this business and think the valuation could be appealing, on a long-term view.

- Smiths Group (LON:SMIN) - a third consecutive upgrade to FY23 guidance is encouraging and I like the business, but I'm reserving judgement on this industrial group until I see fresh accounts and FY24 guidance. .

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

TP ICAP (TCAP)

"We remain well positioned and expect interest rates to remain at elevated levels throughout the year; at the same time, the benefit of the recent strong US Dollar is now moderating."

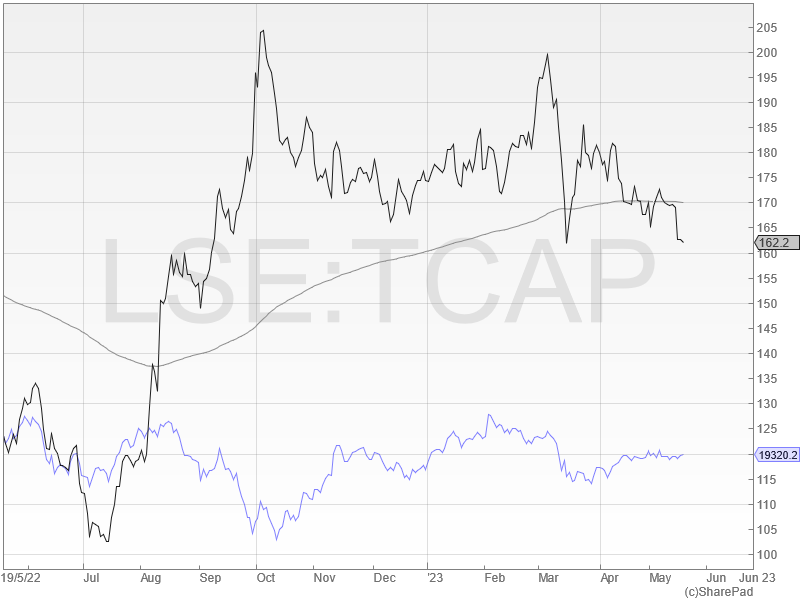

Back in May 2022 I took an in-depth look at interdealer broker TP ICAP.

I concluded the shares – then yielding 8% – could offer value. But I warned that the business was hard to understand and had a mixed track record. I wasn't sure if recent improvements were sustainable.

A year later, where are we now? TP ICAP shares are trading a little higher and have outperformed the FTSE 250 over the last year. But the yield is still close to 8%.

Trading update: this week's update was only and AGM update so did not contain much detail. But management did provide a summary of divisional performance and a short strategic update.

Here are the main highlights, covering revenue for the three months to 31 March 2023:

- Group revenue up 9% to £606m (+2% constant currency)

- Global broking up 9% (+3% constant currency) - "all asset classes generated low to mid-single digit growth". TP ICAP is the market leader in interdealer broking, with a market share of more than 40%.

- Energy & Commodities up 10% (3% constant currency) - there was growth in European Gas & Power, but a flat performance from oil.

- Parameta Solutions up 15% (7% constant currency) - this data analytics division is targeting "double-digit constant currency growth in adjusted EBIT".

- Liquidnet up 3% (down 3% in constant currency) - this equity and fixed income trading network serves institutional clients and was acquired for $575m in 2021, but performance has been disappointing so far. A new divisional CEO has been parachuted in – we'll have to see if performance improves.

The underlying theme tying TP ICAP's divisions together is that they provide liquidity by facilitating transactions between market participants. The broking business does this the traditional way – building relationships and dealing over the phone. The other divisions take various different approachs.

Data business Parameta Solutions generated a divisional operating margin of nearly 45% last year and is also the fastest-growing business. It's recently been certified by the European regulator to act as a benchmark administrator for OTC (over-the-counter - i.e. not traded on an exchange) benchmarks and indices. I'm not sure what the commercial potential of this is, though.

Last year, an activist investor suggested Parameta could be worth £1.5bn – more than TP ICAP's £1.3bn market cap – but I wonder if some of the value of the business depends on its inclusion in TP ICAP's data ecosystem.

Outlook/my view: At a group level, TP ICAP still seems to be performing reasonably well, although management warn that the currency tailwind from the strong US dollar is now easing.

Consensus forecasts are unchanged and suggest earnings growth of less than 5% this year, on an adjusted basis. However, the shares trade on just six times forecast earnings and still offer a 7.9% yield, which looks well covered.

This business remains complex and difficult to understand for someone who hasn't worked in the industry. I don't know how market trends are likely to affect future earnings.

However, TP ICAP shares continue to look very affordable to me, so I'm going to keep on following this story.

Savills (SVS)

"the range of potential outcomes for the year as a whole has widened since year-end"

This international real estate services group is currently one of the higher-scoring shares in my dividend screening results.

I looked at Savills' impressive long-term record in an in-depth review in December, so I'd recommend starting there for a more detailed discussion of this business.

This week's trading update was seen by some commentators on Twitter as a profit warning in disguise.

#SVS warns…but in classic estate agent speak🙄 https://t.co/eYhhL6JyYr pic.twitter.com/76ol41jzwc

— Rhomboid1🇺🇦 (@rhomboid1MF) May 17, 2023

I've got some sympathy with this view. I think this week's AGM update contained some pretty clear hints that the rest of the year could be more difficult than previously hoped for.

Trading commentary: management says that global capital transaction volumes so far this year have been "at the lowest levels seen for a decade":

"this has clearly impacted the Group's Commercial transaction business in the early part of the year"

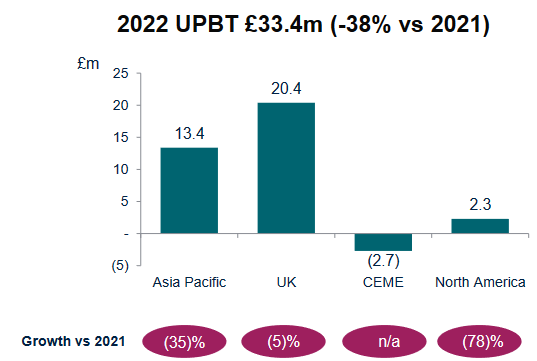

Profits from commercial property transactions fell by 38% to £33.4m in 2022. I wonder if an even larger fall is likely this year?

Fortunately, prime residential transactions are said to have held up better, although volumes are lower than last year.

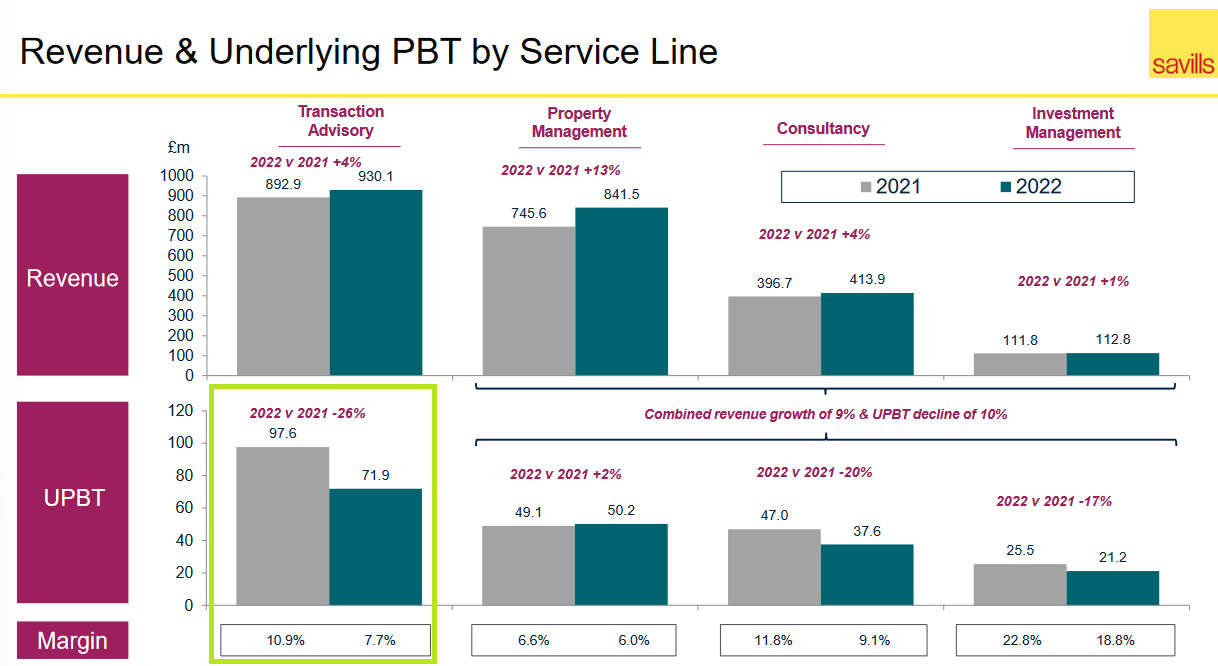

Despite its diversification in recent years, Savills' largest business is still "transaction advisory" – or what most of us would call estate agency.

This slide from the 2022 results presentation shows how profits from this business slumped last year. A further fall seems likely this year:

Fortunately, Savills leasing and non-transactional businesses are said to be performing better.

Outlook: the outlook for the remainder of the year does not seem very positive to me:

"In the year to date, global commercial investment volumes have either reached or approached their lowest levels in many years. As a result, at this early stage, the range of outcomes for the year as a whole has widened..."

The timing of a recovery is "impossible accurately to predict", but...

"we remain optimistic that markets will start to improve in the second half and we are seeing early signs of this in some areas. Confidence in the ongoing recovery and level of transactional velocity through the latter part of the year will be key to supporting our view that 2024 will show transaction volume growth in most markets."

I think it's hard to avoid the conclusion that management are simply keeping their fingers crossed that things will improve soon enough to prevent a profit warning.

I'm not entirely convinced. However, this slump may give Savills – which has a strong balance sheet – an opportunity to acquire businesses and key personnel at attractive prices:

"In the meantime, we continue to pursue opportunities to develop our business both through targeted recruitment and selective acquisition."

My view: as I've discussed in recent coverage of British Land, Tritax Big Box, and Derwent London, it's not clear to me how close we are to the bottom of the commerical property slump.

However, the collapse in commercial transaction volumes suggests to me that markets have not yet adjusted to the reality of higher interest rates.

My feeling is that there's an element of denial at work, with market participants hoping that rates will quickly reverse. Personally, I'm not sure that's likely. I note that financial firm TP ICAP (above) also expects interest rates to remain high for at least the rest of this year.

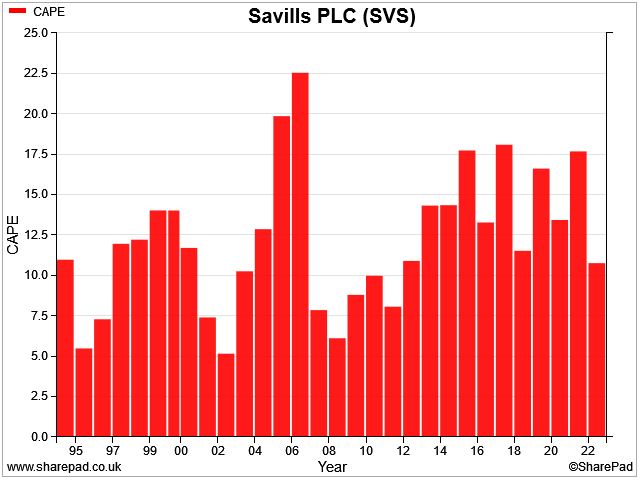

What does seem clear to me is that Savills' shares look quite cheap on a historic view.

In situations like this, I like to use the CAPE ratio. This modified P/E ratio compares the current share price with 10-year average earnings. It can be a useful tool for working out when cyclical businesses are cheap on a through-cycle view.

According to SharePad data, Savills' CAPE of 10.8 is the lowest seen since 2011. The shares are not quite at the distressed level seen in 2008, but I think they're certainly cheaper than they've been for a decade:

Broker forecasts price the stock at 12 times 2023 forecast earnings, with a 3.8% dividend yield.

City analysts are still pricing in a recovery in earnings in 2024 that could push the forecast P/E down to 10x.

I don't know how likely this is. But I think that at c.900p, Savills shares are probably getting down to a level where they offer value as a long-term buy.

Mind you, the stock traded as low as 750p in September last year. That price would lift the dividend yield to nearly 4.5%.

A better opportunity could be just round the corner. Or perhaps the optimists are right, and the current slowdown will pass without too much pain.

I don't know. But I remain positive about the long-term outlook for this market-leading business and might consider buying at current levels.

Smiths Group (SMIN)

"Continued strong growth and increased FY2023 guidance"

Smiths Group is a engineering conglomerate that owns four fairly specialised businesses. Products include airport security scanners and electronic components used in figher jets, for example. The company's website has more information.

In amongst the gloom and uncertainty, it's good to see a UK industrial company upgrading its guidance for the year. In fact, it's Smith's third consecutive upgrade.

Friday's Q3 trading update covered the nine months to 30 April. Management say that the strong trading seen in H1 has continued, triggering an upgrade to full-year guidance:

"we are raising FY2023 guidance to around 10% organic revenue growth with moderate margin improvement."

This guidance follows an upgrade to "8% organic revenue growth" in March and "at least 7%" in January.

The company's original guidance for the current year (ending 31 July) was "4%-4.5% organic revenue growth with moderate margin improvement".

This success perhaps isn't such a surprise though, if you consider that core market sectors for the firm include oil and gas, aerospace and airport security. All of these markets have benefited from increased activity levels over the last year.

My view: Smiths' share price is unchanged at the time of writing on Friday, suggesting that a strong results was already priced into the stock.

Broker consensus forecasts suggest earnings of 90.6p per share, with a dividend of 42.3p. That's equivalent to a P/E of 19 and a 2.5% yield.

That may not seem obviously cheap, but this business has generated consistent double-digit operating margins in the past (until 2020). Based on the improving performance trend suggested by the results, I don't think the shares are necessarily too expensive.

However, past accounts have showed quite high levels of adjustment. I'm also a little wary that the sector tailwinds Smiths has benefited from over the last 12 months could ease – or at least normalise – over the coming year.

I'll probably wait for the full-year results and FY24 guidance before looking at this business again. But it's certainly a company that's on my radar as a possible long-term buy at the right price.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.