Dividend notes: cyclical opportunities? BBOX, BP, RWA, TW (08/08/23)

I consider the appeal (or not) of cyclical dividends from BP, Taylor Wimpey, Tritax Big Box REIT and Robert Walters.

In this update I'm looking at four cyclical businesses from different sectors of the economy. All four offer potentially attractive dividend yields that range between 4% and 8%.

I wouldn't buy all of these shares today, but there are some I'd consider. I can definitely see some value among this selection of UK dividend shares.

Companies covered:

- Tritax Big Box (LON:BBOX) - Last week's interim results from this warehouse REIT confirm my prevous view that this stock could be attractive, with a fairly safe 5% yield.

- BP (LON:BP) - profits fell by 50% during the first half of this year, but remain very high by historical standards. BP's dividend is being rebuilt, but as I explain, the shares are not yet cheap enough to tempt me.

- Robert Walters (LON:RWA) - half-year results show a dramatic slump in profits as operating leverage kicks in. However, net cash covers a quarter of the group's market cap and supports a 6% yield. I think the business could be attractively valued on a cyclical view.

- Taylor Wimpey (LON:TW) - this housebuilder looks in reasonable shape and offers a yield of nearly 8%. I discuss the potential sustainability of TW's dividend policy, given what we know so far.

Tip: to search for my previous coverage of a company, enter its ticker code into the search tool at the top of this page.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Tritax Big Box (BBOX)

"approaching 10 years of consistent 100% rent collection"

I covered this warehouse REIT's half-year update back in May. At that time, I was cautiously optimistic and considered that the shares could offer reasonable value.

In my view, BBOX is one of the best quality of the current crop of logistics REITs. It has a large portfolio of modern property and good quality, investment grade tenants (most notably, Amazon).

Last week's half-year results do not seem to have contained any fresh bad news.

NAV: Property valuations remained stable and net asset value per share rose by 1.5% to 183p. This means that the shares currently trade at a discount of around 20% to their book value.

Dividend: the interim dividend will rise by 4.5% to 3.5p per share (paid quarterly). This payout was covered comfortably (for a REIT) by adjusted earnings of 3.94p. In this case, I think this is a reasonable proxy for surplus cash generated from rental income.

Consensus forecasts suggest a full-year payout of 7.2p, giving a prospective yield of 5.1%.

Debt/leverage: a weighted average cost of debt of 2.6% looks competitive, with the majority at fixed rates.

The REIT's average unexpired lease period (WAULT) of 12 years should provide good visibility on cash generation.

The only possible risk that I'd flag up is that BBOX has a £450m RCF (overdraft) that's due for renewal by the end of next year. This represents around 25% of its borrowing capacity, although only £129m was drawn down at the end of June.

Work is underway to renew this facility. I don't expect a problem, but the cost is likely to increase.

My view

On balance, my feeling is that Tritax Big Box's half-year results support the view I took in May. I think BBOX shares could offer decent value and a reasonably safe 5% yield at current levels.

BP (BP)

"we're delivering for shareholders growing our dividend and announcing a further share buyback"

BP's results contained a surprise 10% dividend increase. This was a bigger increase than I expected, given that BP's underlying replacement cost profit fell by almost 50% to $7.6bn during the first half of this year (H1 2022: $14.7bn).

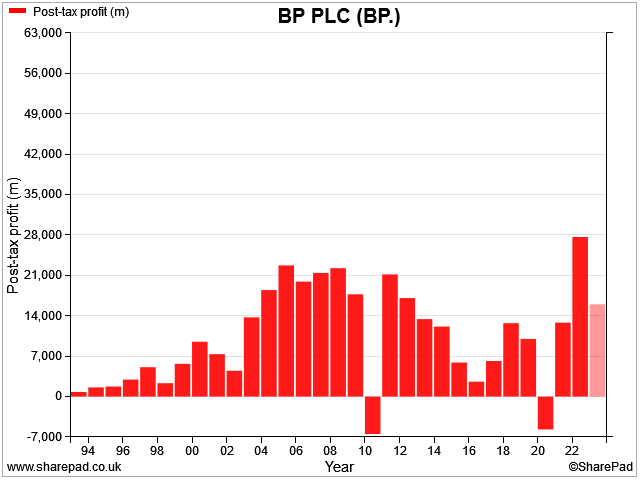

However, I think it's worth remembering that BP's profits remain very strong in a historic context, even factoring in this year's forecast decline (the shaded bar):

CEO Bernard Looney has sensibly kept the dividend payout ratio low during this period of bumper profits.

Overall, I think BP is in good shape right now. Oil and gas prices remain supportive, debt levels have fallen, and operating costs appear to be under control.

Valuation/yield: my main interest in this business lies in assessing the valuation of the stock and the sustainability of BP's dividend.

BP's forecast P/E of 6.7 looks low and the stock's trailing free cash flow yield of c.20% is also remarkably cheap.

However, as I explained in my recent in-depth review of Shell, I believe that BP and Shell's dividend yields provide a more objective, through-cycle measure of valuation.

On this basis, BP's forecast dividend yield of 4.4% looks no better than average to me.

Sure enough, we can see that historically, the current share price of c.480p has typically been a mid-cycle valuation – neither expensive nor cheap:

In contrast, I think BP has generally been an attractive buy at under 400p. At this level today, BP shares would provide a forecast yield of 5.3%.

As things stand, I don't see much attraction in buying BP (or Shell) with a yield under 5%.

I see BP as a mature and cyclical business with a limited ability to deliver structural growth. So I'd want the shares to provide a dividend yield above the 5% I can get risk-free, in order protect me from the risk that BP's future performance will reflect its past performance (see above chart).

My view

As I commented in my recent in-depth piece on Shell, there's a risk that I'm wrong about BP (and Shell).

Perhaps both companies will be able to become less cyclical and more profitable than they have been in the past.

Or maybe oil and gas prices will stay higher for longer, powering a long period of stable profits.

Maybe it will be different this time...

I can't rule out these possibilities entirely. But personally, I don't see it. The good times could keep rolling for a while yet.

But at some point, I expect that the usual cyclical forces and cost pressures will become an issue again, especially when the energy transition comes back into focus (assuming this happens).

BP's (and Shell's) current focus on jumbo-sized share buybacks suggests to me that both companies' boards share my view that future profits are likely to be lower.

As a long-term investor, I aim to buy cyclical shares at a valuation that's cyclically attractive. In other words, at the lower end of the company's historic valuation range, reflecting cyclical swings in profits.

I don't think BP shares are at this level today. But if the share price continues to drift down towards 400p, I might revisit this view.

Robert Walters (RWA)

"Candidate and client confidence levels have yet to show sustained improvement across many of the Group's markets and specialist disciplines."

It's (relatively) tough out there for recruiters at the moment, especially in the UK, US and China. These geographies were highlighted as weak spots in Robert Walters' half-year results. They were also flagged up by larger rival PageGroup in its recent interims.

RWA's share price action since October 2022 provides a reminder of the cyclicalty of this sector. The stock is down by more than 50% from its post-pandemic peak:

I covered Robert Walters' half-year trading update in July, but I think the full numbers are worth a brief look. In my view, they highlight the powerful operating leverage at work here – and suggest a possible buying opportunity.

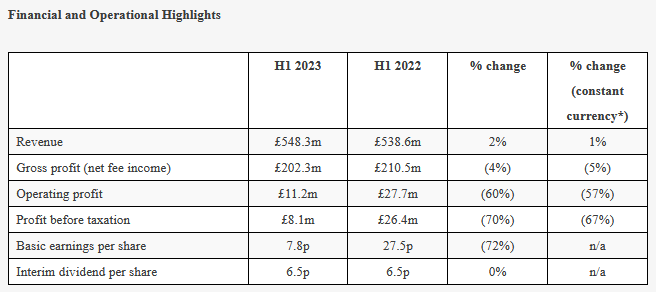

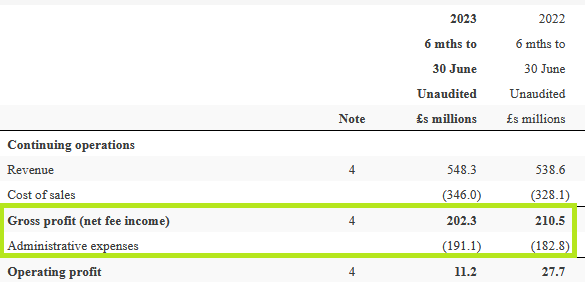

H1 results highlights: gross profit (or net fee income, a proxy for revenue) only fell by 4% to £202.3m during the six months to 30 June.

But this resulted in a 67% drop in Robert Walters' pre-tax profit, which fell to just £8.1m.

What's happened is that a small drop in fee income has been set against an increased fixed cost base, compared to the same period last year:

Administrative expenses – primarily payroll – have increased over the last year. Because these overheads consume the majority of gross profit, the impact on operating profit is dramatic.

Companies which cannot flex their operating costs in response to changes in sales can deliver big swings in profit. This is known as operating leverage. It can work in both directions; up and down.

Why are costs rising? Robert Walters' costs appear to have risen because the company is actually employing more people than it was one year ago. Management says headcount was 6% higher at the end of June than it was the previous year.

Although the company says that headcount fell by 3% in Q2 (vs Q1), new chief executive Toby Fowlston says he's keen to "protect the Group's strategic core". Understandably, he wants to ensure the business well positioned to benefit from the eventual upturn.

Fowlston has only recently taken charge following the retirement of founder-CEO Robert Walters. I'd imagine his strategy to date will have followed Walters' playbook fairly closely.

Cash provides margin of safety: it's too soon to know whether this cyclical judgement will be proved correct. But a net cash balance of £69.8m (H1 2022: £81.8m) should provide a substantial safety margin, as long as the business remains profitable.

This cash balance represents almost a quarter of the current market cap, or around 95p per share.

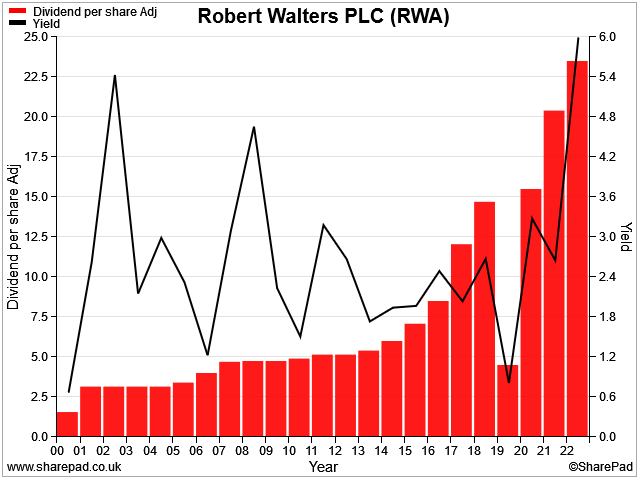

It's probably worth noting that Robert Walters didn't need to cut its dividend in 2008/9. Indeed, the firm has not cut its payout for more than 20 years. This suggests to me that the current high dividend yield could represent an opportunity:

Outlook: CEO Fowlston says that over the last two years, the group has invested in developing its global infrastructure and "attracting and developing our people".

He rightly points out that the company has a global brand and strong balance sheet, giving the group the capacity to take a longer view.

Current trading is said to remain in line with Board expectations, which were revised down following June's profit warning. Earnings per share are expected to fall by 47% to 29.6p per share (2022: 56.2p per share).

These forecasts put RWA stock on a 2023 forecast P/E of 13, with a 6% dividend yield that remains covered by forecast earnings.

My view

Recruiters like Robert Walters are fantastically profitable during the good times. Return on capital employed at this business peaked at over 30% in 2017/18 and has averaged 24% over the last six years.

The business is highly cash generative, has a strong balance and experienced management. I would imagine that the founder-led culture of the business remains strong, even though Robert Walters has now retired.

The shares now trade on just 12 times 10-year average earnings (CAPE), the lowest level seen since 2011. The share price chart also looks attractive to me, assuming the business can maintain its long-term growth record:

I think there's definitely some risk of further volatility and earning downgrades.

But in my view, Robert Walters shares are likely to offer good value and sound prospects from current levels.

This is a stock I would consider buying for my dividend portfolio at the moment.

Taylor Wimpey (TW)

"we have delivered a resilient performance with first half completions slightly ahead of our expectations."

When I covered this FTSE 100 housebuilder in April, I noted that the company's guidance for the year suggested it would complete 9,000-10,500 homes – roughly a 30% fall from 2022.

The group's half-year numbers include updated guidance for completions of 10,000-10,500 in 2023. It looks like demand has been stronger than first feared. Let's see how this affects the numbers – and dividend prospects – for this business.

H1 financial highlights: Taylor Wimpey's revenue fell by 21% to £1,637.1m during the period.

In a further example of operating leverage in action (see Robert Walters, above), the group's operating profit fell by 44.5% to £235.6m (H1 2022: £424.6m).

However, one benefit of a shrinking order book is that it allows housebuilders to release cash from working capital. There's less money tied up in materials and work in progress.

As a result, Taylor Wimpey's net cash balance rose by 2% to £655m during the half year, despite a substantial reduction in money owed for land purchases.

Including these so-called land creditors, the firm swung from net debt of £201m in June 2022 to net cash of £67m at the latest half year.

Net asset value remained unchanged at 126.7p per share (Dec 2022: 126.5p).

Profitability remained reasonably healthy, in my view. The group's H1 operating margin fell to 14.4% (H1 2022: 20.4%).

My calculation of return on capital employed shows ROCE falling from 16% last year to just over 14%, on a trailing 12-month view.

Dividend: Taylor Wimpey's dividend policy is to pay out 7.5% of net asset value, or at least £250m annually throughout the cycle.

This year's forecast payout of 9.2p per share will cost around £325m. This tells me the dividend could be cut by nearly 25% while remaining within the firm's policy. I estimate the minimum payout would be about 7p per share, after which a new dividend policy might be needed.

The company says the current policy has been stress tested to include conditions including "up to a 20% fall in house prices and 30% decline in volumes".

The firm's numbers suggest that we aren't far off from a 30% decline in volumes compared to 2022. But house prices have (so far) remained fairly stable.

Average selling prices actually rose by 6.7% to £320k during the half year, although we aren't told how much of this is due to mix effects (i.e. larger, more expensive homes). Prices are generally said to be falling.

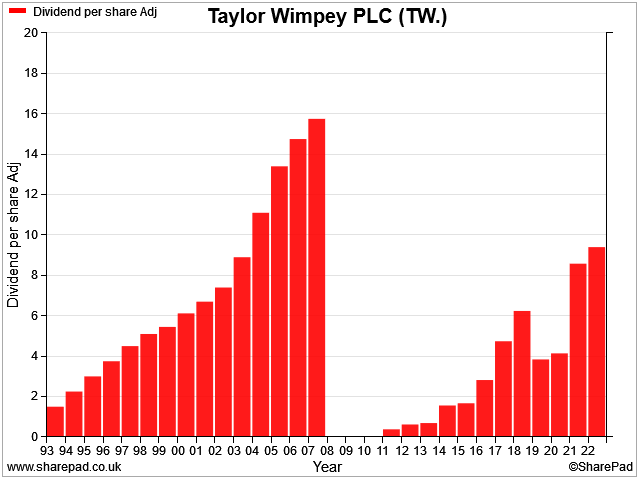

On balance, Taylor Wimpey's dividend looks safe to me at the moment. However, I'm not sure it's quite as robust as the company's narrative might suggest. Historically, this business has not managed to provide "increased certainty of a reliable income stream through the cycle":

Outlook: the "seasonally quieter" third quarter has started, well, quieter. TW's net private sales rate was 0.47 per outlet per week, 18% below the 0.57 per week reported for the Q3 period last year. Cancellations are slightly higher, too.

The order book stood at £2,175m at the end of July (2022: £2,893m), representing 7,900 homes (2022: 10,392 homes).

Full-year operating profit including joint ventures is expected to be £440m-£470m, with net cash at £500m-£650m.

Consensus forecasts suggest this will equate to earnings of 9.1p per share, with a 9.2p per share dividend. This prices the shares on a forecast P/E of 13, with a 7.8% yield.

My view

Taylor Wimpey chief executive Jenny Daly says buyers are taking longer mortgages to help offset the impact of higher mortgage rates.

Apparently, 27% of first-time buyers are taking mortgages over 36 years, compared to 7% in 2021.

For second-time buyers, 42% are taking mortgages with durations over 30 years, compared to 28% in 2021.

If this is truly representative of what's being seen across the housing market, I think it could be a leading indicator of weak/sluggish house prices for the foreseeable future.

We could even see a slow-motion house price crash, as my fellow dividend investor John Kingham has suggested.

However, I don't think this necessarily needs to be a big concern for housebuilders and their shareholders. Costs are stabilising and TW's profit margins remain in double digits. The build-to-rent market also seems likely to remain strong.

I don't see why housebuilding won't remain a profitable and cash-generative business, especially for larger firms.

Taylor Wimpey has plenty of cash and trades below book value. The 7.8% dividend yield looks sustainable to me, albeit not rock solid.

On balance, however, I think this business is probably attractively valued as a potential investment at current levels. I already own another housebuilder, but if I didn't, I might consider TW.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.