Dividend notes: property special - SVS, PSN, DLN, RECI (10/08/23)

I review recent results from Savills (profit warning), Persimmon, Derwent London and property lender Real Estate Credit Investments.

Welcome back to my dividend notes. In today's report I've focused on recent news from four property stocks. They're all very different businesses, but I think the common threads I'd draw are that:

- Value and quality is available for equity investors in this sector, selectively

- Balance sheet strength is more important than ever

- It could take the market longer to adjust to higher interest rates than expected

- Property prices are likely to fall, in general

No great surprises here, probably. Let's take a look at the company-specific news.

Companies covered:

- Savills (LON:SVS) - half-year profits have slumped at the real estate group due to a collapse in transaction volumes. I continue to like this business on a long-term view, but feel that patience may be needed.

- Persimmon (LON:PSN) - not my favourite housebuilder, but a reasonably reassuring update, in my view.

- Derwent London (LON:DLN) - today's half-year results confirm my view that this is one of the best quality REITs out there, at a potentially attractive valuation.

- Real Estate Credit Investments (LON:RECI) (I hold) - a solid update from this specialist property lender. The 9.5% yield still looks sustainable to me, but this niche stock isn't without risk.

Tip: to search for my previous coverage of a company, enter its ticker code into the search tool at the top of this page.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Savills (SVS)

"our range of expectations for the year as a whole has reduced somewhat"

International real estate group Savills says full-year profits will now be lower than expected, due to a sharp slump in property transaction volumes.

I last covered Savills in May when I (and others) suggested that the firm's AGM update was a profit warning in disguise.

I've also covered Savills previously in an in-depth dividend share review last December.

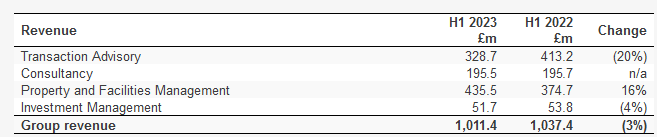

Half-year highlights: Savills revenue fell by 2.5% to £1,011.4m during the first half of the year, but the group's reported pre-tax profit fell by 88% to just £6m.

The reason for this profit slump is that the company has maintained its staffing levels and continued to invest in IT and other areas. This will allow it to maintain good relationships with existing customers and be well-positioned for when market conditions improve.

As a result, Savills operating costs rose by 2.4% to £972m during the first half of the year, compared to the same period last year.

This is another example of operating leverage in reverse, similar to what we saw with recruiter Robert Walters earlier this week.

Savills' net cash balance fell to just £12.9m during the period (H1 2022: £149m) but I don't think this is as worrying as it sounds. The group's cash generation is generally heavily weighted to the second half of the year.

Trading commentary: with the exception of its transaction advisory (estate agency) business, Savills' performance seems to have been quite strong during the first half. All other parts of the business reported stable or rising revenue:

The UK delivered the biggest hit to revenue. The firm's home market generates about 40% of group revenue, but management said UK commercial property transactions fell by 60% during the first half of the year and were 46% below the five-year average.

Commercial property transactions were also subdued in most of the company's main overseas markets, due to valuation issues and the uncertain economic outlook.

Dividend: Savills has increased its interim dividend by 4.5% to 6.9p per share and reiterated its policy that the dividend "is designed to provide sustainable real income growth and be supported by the less transactional business earnings".

I don't expect the payout to be cut unless conditions get significantly worse.

Broker forecasts ahead of today's results suggested a payout of 36p per share this year, giving a 4% yield.

Outlook: Savills' view is that many market participants are waiting to see where interest rates settle down before committing to major transactions.

"Market participants, whether investors or occupiers, seek greater certainty on the trajectory of interest rates over the next 18 months, something which has become somewhat clearer in recent weeks than for much of the period."

The company says it can see some positive signs but paints a mixed picture:

"We are seeing some positive signs in markets such as the UK and continued strength in certain Asia Pacific markets including Japan; in Continental Europe and mainland China we now expect reduced market volumes to continue through much of the year."

Frustratingly, there's no clear guidance given on the group's revised expectations:

"Accordingly, our range of expectations for the year as a whole has reduced somewhat."

My view

Today's downgrade probably shouldn't be a big surprise. But I don't see anything to suggest the fundamental qualities of this business have changed. I expect Savills to emerge from this downturn in reasonable financial shape.

The main area of uncertainty for me is whether Savills may struggle to regain the momentum seen over the last decade, against a backdrop of higher interest rates. I think there's a risk that the property market could take longer to adjust to rising rates than is currently expected.

Despite this, I am confident Savills will remain a profitable and market-leading business.

On balance, I think the shares are probably relatively attractive at current levels on a long-term view, although I wouldn't be surprised to see a bit more downside from here.

Even after today's drop, Savills' share price is actually higher than it was at in December 2022, when I reviewed this business.

Persimmon (PSN)

"operating profits in line with expectations given stubborn build cost inflation in the period"

FTSE 100 housebuilder Persimmon says that it expects to build "at least 9,000" homes this year, at the top end of the company's previously-guided range.

However, the firm said that "stubborn" cost inflation and a slowdown in Q1 hit profit margins during the first half.

Half-year highlights: Persimmon completed 4,249 homes during the first half of the year, a 36% reduction on the 6,652 completed in H1 last year.

This fall was reflected in a 30% drop in revenue, which fell to £1.19bn.

Underlying operating profit for the half year fell by 65% to £152.2m, reflecting lower volumes and cost inflation. As a result, operating margin for the half year fell from 27% to 14%.

Margins were also hit by an increased proportion of sales to housing associations. These accounted for 23% of completions during the half year, up from 17% last year.

Persimmon's net cash balance fell from £780m to £360m, while land holdings fell from 89,052 to 84,751, reflecting completions and a slower pace of buying. Slimming down their land banks is one trick housebuilders can use to release more cash during a downturn.

Net assets per share fell by 2.4% to 1,050.7p in H1. Persimmon is relatively asset-light compared to some rival firms and is still trading slightly above its book value at the time of writing.

Management say that average selling prices rose by 4.4% to £256,445 during the first half, but this included "a greater proportion of larger homes".

The firm's sales force is also making "controlled use of incentives" such as part-exchange. This accounted for 3.2% of private sales during the half year.

I would argue that these facts suggest that like-for-like selling prices net of incentives are not rising, and may well have fallen slightly. However, the big risk for housebuilders isn't so much falling prices as a collapse in volumes.

Broadly speaking, firms can build and sell homes profitably at any reasonable price, as long as they haven't overpaid for land holdings. But they can't make money if they can't shift any houses.

Transaction volume is the lifeblood of this business, not price growth.

Dividend: Persimmon will pay an interim dividend of 20p per share. This is in line with a new dividend policy introduced last year that saw payouts fall by 75% from their previous levels.

Full-year forecasts for a payout of 62.3p per share look reasonable to me and suggest a prospective yield of 5.5%.

Outlook: Persimmon's forward sales position is currently said to be £1.6bn, down from £2.2bn at the same point last year. The company expects to complete "at least 9,000" homes this year, at the top end of previous guidance.

However, operating profit is only expected to be "in line", due to "stubborn build cost inflation".

Broker forecasts suggest earnings of 83.9p per share, putting the stock on a forecast P/E of 13.

My view

Persimmon isn't my favourite housebuilder, as I'm not a fan of the company's strategy of paying dividends that represent almost all its earnings.

I prefer a focus on dividend sustainability and higher levels of cover during the good times. My pick among housebuilders is Bellway, which I added to the model portfolio in October last year (subscribers only).

I also prefer to buy property stocks at a discount to their book value, to provide a margin of safety. Even so, I don't see any particular concerns in Persimmon's half-year numbers.

There's still a risk that market conditions will continue to worsen. But for now, the company's shift to bulk deals and its low price positioning seems to be helping sustain its performance.

Derwent London (DLN)

"We have delivered over £26m of new leases in 2023 to date, a near record level"

Demand for offices with high sustainability ratings is a key theme in commercial property at the moment.

Derwent London provides us with another example of this today. This London office REIT has secured lettings of £26m so far this year, a new record for the firm.

These new lettings were priced at an average of 8.3% ahead of December 2022 estimated rental values, suggesting healthy demand.

Derwent specialises in redeveloping office properties to high specifications. Its portfolio is focused on prime London areas, particularly the West End.

I've previously commented favourably on the quality and value I think are on offer here. Today's half-year results do nothing to change that view.

Half-year highlights: Derwent says new lettings in H1 included sizeable deals with tenants such as PIMCO, Moelis, Buro Happold, and Uniqlo. Vacancy rates have fallen to 4.5%, from 6.4% at the end of 2022.

Gross rental income for the half year rose by 3.9% to £105.9m, but falling property prices meant that the Derwent's EPRA earnings (an industry metric) fell by 7% to £55.6m, or 49.5p per share.

Falling portfolio valuations essentially reflect higher interest rates – landlords need higher rental yields in order to finance properties.

Derwent's total property return fell by 2% in this environment, outperforming its benchmark which dropped 3.2%. (Total property return = change in capital value, less capex, plus net income)

Net asset value: Derwent's NAV per share was 3,444p at the end of June. That's a reduction of 14% over the last year. (June 2022: 4,023p).

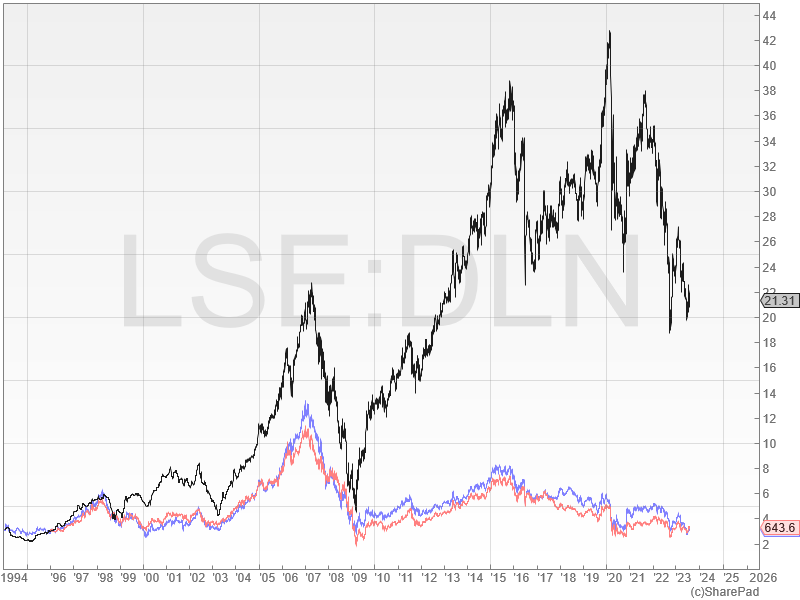

The shares are trading at 2,160p as I type, giving a discount of 37%. I think that's a comfortable margin of safety on a high-quality London portfolio.

Balance sheet: there's still a lot of uncertainty about the outlook for commercial property. For equity investors, it's worth remembering that equity is the first capital layer to get wiped out in a refinancing.

In my view, it makes sense to focus on REITs with low debt levels and good cash flow visibility on existing leases. Derwent is one of the best at the moment, in my view:

- Loan-to-value ratio of 25%

- 98% of borrowing at fixed rates with £562m of undrawn facilities and cash

- Weighted average debt term to maturity of 5.6 years

- Portfolio weighted average unexpired lease term (WAULT) of 7.2 years

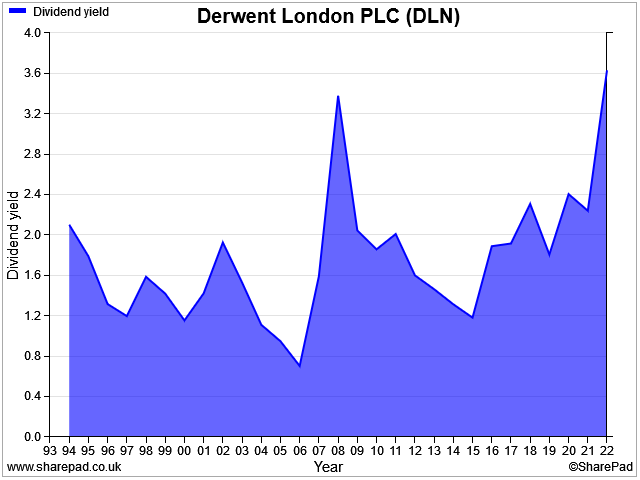

Dividend: the interim dividend has increased by 2.1% to 24.5p per share. Broker forecasts suggest a payout of 80.8p per share this year, giving a prospective yield of 3.7%.

That's an unusually high yield for this stock, according to SharePad data:

Outlook: management guidance is unchanged. Derwent says its portfolio should be more resilient than the wider London office market and expects to report a 0%-3% rise in estimated rental values (ERV).

My view

I continue to think Derwent London is one of the better quality listed commercial property REITs. With a strong balance sheet and the shares trading nearly 40% below book value, I believe there should be some value here.

Although British Land and Landsec both offer much higher yields – a potential attraction – Derwent London's share price has outperformed both by a sizeable margin over the last 25 years:

We can't be sure that the share price has bottomed out yet. The full impact of rising interest rates is still unclear, as today's update from Savills makes clear.

Even so, I'd be comfortable adding DLN to my portfolio today on a medium-term view.

Real Estate Credit Investments (RECI)

"Dividends maintained at 3p per quarter, 9.5% yield, based on share price, as at 30 June 2023"

RECI is an investment company. It provides senior loans to property developers. These are typically short-term, with an average duration currently of 1.8 years.

The business is externally managed by Cheyne Capital, a specialist real estate business with $5bn of real estate assets under management.

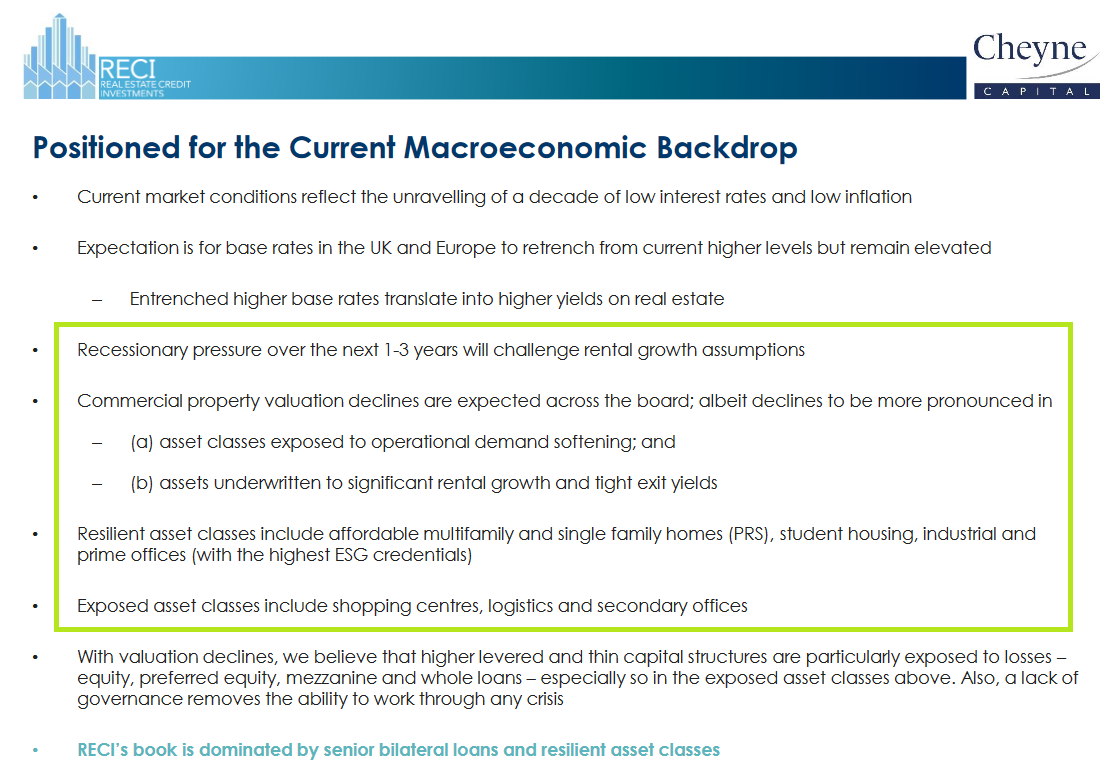

The company's latest update covers its fiscal first quarter, ending 30 June. The company's presentation started with some interesting (and somewhat bearish) commentary on the outlook for commercial property over the next few years:

Q1 update: the comments above make sense to me and seem consistent with commentary from other market participants. But to some extent, RECI may be talking its book.

RECI's loan book doesn't have much exposure to sectors identified as risky above. Its focus on senior loans also means that it should be the last to take losses if the value of properties in its portfolio falls.

Although the average loan-to-value ratio on RECI's loans is 60%, the company's own balance sheet is not so heavily geared. Repayments on several projects saw RECI's debt-to-equity ratio fall from 30% to 25% during the quarter.

As a result, net assets per share rose to 149.9p (31 Mar 23: 146.9p per share).

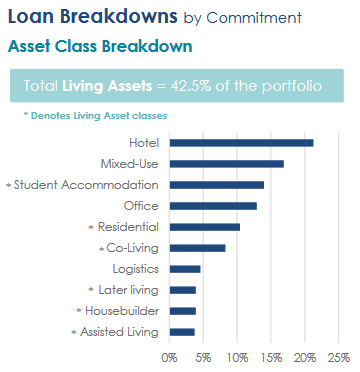

RECI currently has 45 investment positions (including some market bonds) with a net value of £338.2m, including the company's £28m cash balance. There's a bias towards residential assets of various kinds, but the largest single class is hotels:

The UK accounts for 60% of assets, with the remainder spread over selected western European countries.

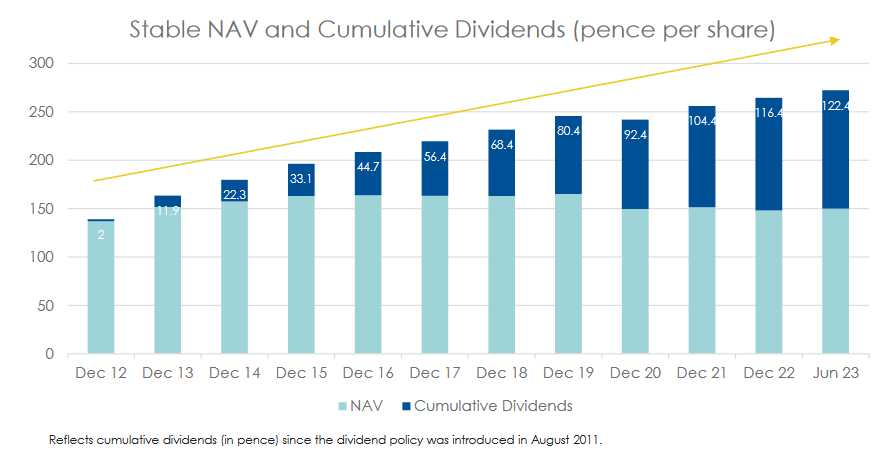

Although RECI isn't a REIT, it targets a dividend payout of around 7% and has – in practice – paid out most of its profits as dividends over the last decade:

Outlook: RECI says it continues to have an attractive pipeline of deals offering attractive rates of return. Bank lending is expected to remain constrained, delivering "a compelling emerging opportunity set in senior loans".

My view

I hold this share outside my main dividend portfolio. My impression is that it's well-run and focused on a specialist sector of the market where Cheyne Capital has good skills.

However, I'm aware that the current dividend policy has only been in place since 2011. So it hasn't yet been tested in a rising interest rate environment.

There's also the risk that some of RECI's projects may yet go wrong, resulting in NAV impairments. Problem loans can often take a while to emerge in a downturn.

I see this as a specialist and somewhat riskier investment than – say – British Land (no position).

However, RECI's 9.5% dividend yield looks sustainable to me based on the information available today. I remain happy to hold.

Disclosure: at the time of publishing, Roland owned shares in RECI and Bellway.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.